Invoice Management System (IMS) for Efficient GST Input Tax Credit (ITC) Management

Services

Business Incorporation & Compliance

Registration & Certification Services

GST Advisory & Compliance

Income Tax Advisory & Compliance

Accounting and Payroll Services

Audit & Assurance Services

International Tax Services

UAE Business Services

Financial Insights

Detailed Summary of CBIC Instruction No. 03/2025-GST

Union Budget 2025: Goods and Services Tax Comprehensive Overview

Union Budget 2025: Direct Tax Comprehensive Overview

Detailed Summary of Recommendations from the 54th GST Council Meeting

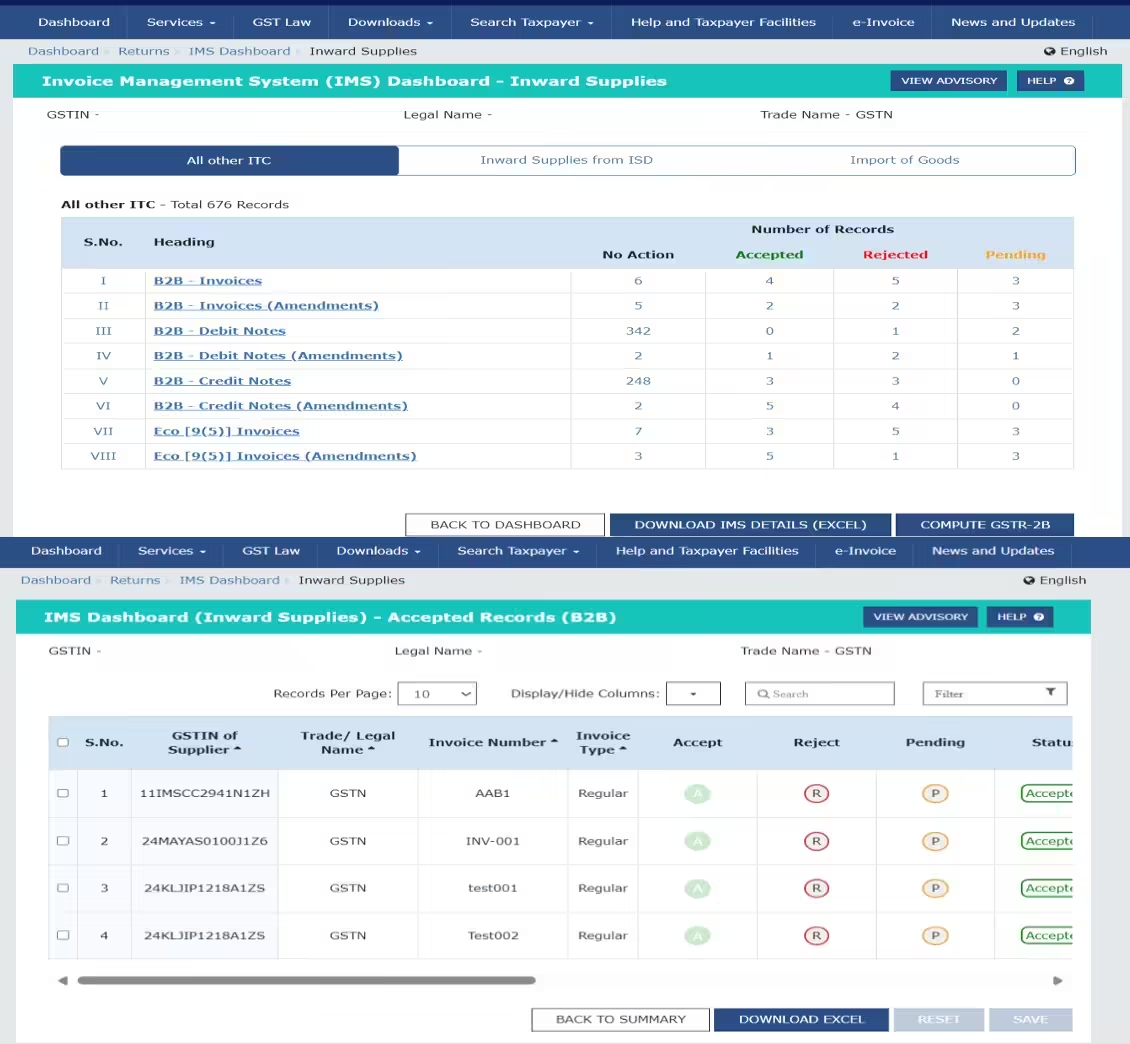

To streamline the process of invoice corrections and amendments for taxpayers, the GSTN is introducing a new communication system through the GST portal. This new functionality, called the Invoice Management System (IMS), will help taxpayers manage their invoices more effectively, ensuring accurate matching of records with their suppliers. The IMS allows recipients to accept, reject, or keep invoices pending, thus facilitating correct Input Tax Credit (ITC) claims.

Key Features of the Invoice Management System (IMS):

- Availability: The IMS will be live from 1st October on the GST portal. This system is a significant enhancement in the GST ITC ecosystem, ensuring that only accepted invoices by recipients will reflect in their GSTR-2B as eligible ITC.

- Invoice Review: Once a supplier saves an invoice in GSTR-1, IFF, or GSTR-1A, it will appear in the IMS dashboard for the recipient to review. The recipient can then accept, reject, or mark it as pending until they file their GSTR-3B.

- Deemed Acceptance: If no action is taken on an invoice by the recipient before the filing of GSTR-3B, it will be deemed accepted and moved to the GSTR-2B.

- Amendments: If the supplier amends an invoice before submitting GSTR-1, the amended invoice will automatically replace the original one in the IMS. Any amendment made through GSTR-1A after filing will be reflected in the next month’s GSTR-2B.

Pending Invoices and Amendments:

- Invoices marked as pending can be acted upon later but must be addressed before the deadline set by Section 16(4) of the CGST Act, 2017.

- Invoices amended after filing through GSTR-1A will appear in the IMS and the subsequent month’s GSTR-2B.

How IMS Impacts the ITC Claim Process:

- Accepted invoices will be reflected in the GSTR-2B and automatically considered for eligible ITC in GSTR-3B.

- Rejected invoices will not be considered for ITC claims in GSTR-3B.

- Pending invoices will remain in the IMS dashboard and can be accepted or rejected in future periods.

IMS for Quarterly Return Monthly Payment (QRMP) Taxpayers

For QRMP taxpayers, records and invoices saved or filed through IFF will flow into the IMS for recipients. GSTR-2B for QRMP taxpayers will only be generated quarterly, unlike monthly for regular taxpayers.

Important Actions in the IMS:

- Accept: Accepted invoices will be part of the ITC available in GSTR-2B and populate automatically in GSTR-3B.

- Reject: Rejected invoices will be excluded from GSTR-2B and will not contribute to ITC.

- Pending: Invoices kept pending will not appear in GSTR-2B for the current month but can be reviewed later.

Key Points to Note:

- Deemed Acceptance: If no action is taken, the invoice will be deemed accepted when GSTR-2B is generated.

- GSTR-2B Recalculation: If any actions are taken after the draft GSTR-2B generation (14th of each month), recipients must recompute their GSTR-2B.

- Sequential GSTR-2B: GSTR-2B for a new period will only be generated if GSTR-3B for the previous period is filed.

IMS enhances transparency and allows taxpayers to ensure that their ITC claims are based on genuine, accepted invoices. The system is designed to reduce compliance burdens by automating parts of the process, allowing taxpayers to focus only on reviewing and rejecting questionable invoices.

Read More Insights

Standard Chartered Bank vs. The Principal Commissioner Of Central Tax & Others – Telangana High Court Judgment (11 July 2024)

Standard Chartered Bank vs. The Principal Commissioner Of Central Tax & Others – Telangana High Court Judgment (11 July 2024) Home Insights Standard Chartered Bank

Novozymes South Asia Pvt. Ltd. vs. Joint Commissioner of State Goods and Services Tax & Ors. – Gujarat High Court (1st August 2024)

Novozymes South Asia Pvt. Ltd. vs. Joint Commissioner of State Goods and Services Tax & Ors. – Gujarat High Court (1st August 2024) Home Insights

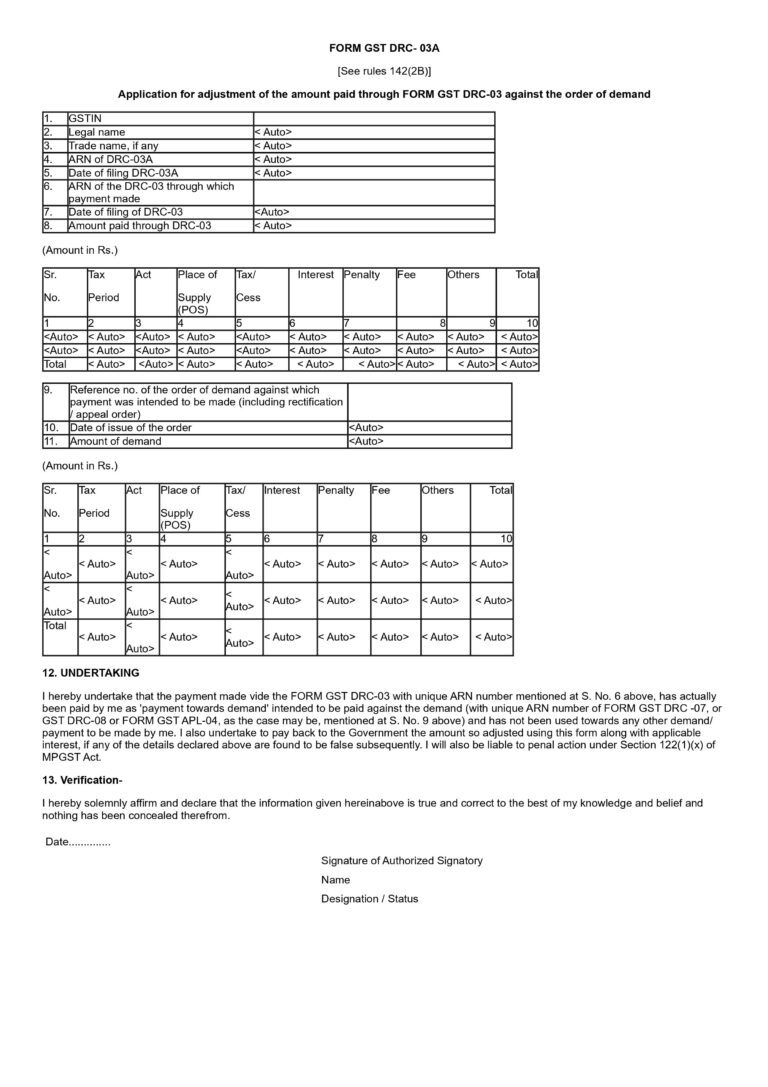

Clarification on GST Payments Through Form GST DRC-03 and Introduction of Form GST DRC-03A

Clarification on GST Payments Through Form GST DRC-03 and Introduction of Form GST DRC-03A Home Insights Clarification on GST Payments Through Form GST DRC-03 and