Napin Impex Private Ltd. vs. Commissioner of DGST, Delhi & Ors. – Delhi High Court (28 September, 2018)

Services

Business Incorporation & Compliance

Registration & Certification Services

GST Advisory & Compliance

Income Tax Advisory & Compliance

Accounting and Payroll Services

Audit & Assurance Services

International Tax Services

UAE Business Services

Financial Insights

Detailed Summary of CBIC Instruction No. 03/2025-GST

Union Budget 2025: Goods and Services Tax Comprehensive Overview

Union Budget 2025: Direct Tax Comprehensive Overview

Detailed Summary of Recommendations from the 54th GST Council Meeting

Union Budget 2025: Goods and Services Tax Comprehensive Overview

Detailed Summary of CBIC Instruction No. 03/2025-GST

Court: High Court of Delhi, New Delhi

Case No.: W.P.(C) 10287/2018

Date: September 28, 2018

Coram: Hon’ble Mr. Justice S. Ravindra Bhat and Hon’ble Mr. Justice A.K. Chawla

Petitioner: M/S Napin Impex Private Ltd., represented by Mr. Surendra Kumar & Mr. A.K. Babbar.

Respondents: Commissioner of Delhi Goods and Services Tax (DGST), Delhi & Others, represented by Mr. Gautam Narayan, Additional Standing Counsel (ASC), GNCTD

Introduction:

In this case, M/S Napin Impex Private Ltd., a registered dealer primarily trading in PVC raisins and other food items such as beverages, filed a writ petition against the Commissioner of Delhi Goods and Services Tax (DGST) and other authorities. The petitioner challenged the sealing of its business premises by the DGST under the provisions of the Central Goods and Services Tax Act, 2017 (CGST Act).

The petitioner argued that the sealing of its premises under Section 67 of the CGST Act, 2017 was illegal and beyond the statutory powers conferred on the DGST officials. The main grievance was that despite cooperating with the authorities, the business premises were indefinitely sealed, causing undue hardship to the petitioner.

Facts of the Case:

- Visit by DGST Officials:

On August 29, 2018, the petitioner’s business premises were visited by officials from the DGST. During this visit, the officials requested the production of books of accounts and other relevant documents. Since the petitioner did not have the required documents on hand, they requested 24 hours to gather them. - Temporary Sealing:

On the same day, the DGST authorities ordered a temporary sealing of the premises, citing the petitioner’s failure to produce the necessary documents. This temporary action was followed by a complete sealing of the premises the next day, i.e., August 30, 2018. - Continued Sealing:

Despite the petitioner’s attempts to cooperate with the authorities, the premises remained sealed. The petitioner contended that the DGST lacked the statutory power to continue the sealing indefinitely. - Petitioner’s Argument:

The petitioner argued that under Section 67 of the CGST Act, the DGST officials could only temporarily restrict access to the premises to ensure the availability of evidence, but they were not authorized to impose an indefinite seal. The petitioner claimed that this was a violation of their rights and that the premises should be de-sealed immediately.

Legal Provisions Involved:

- Section 67 of the Central Goods and Services Tax Act, 2017:

- Section 67(1): Grants the power to the proper officer (not below the rank of Joint Commissioner) to inspect any premises if there are reasons to believe that a taxable person has engaged in activities such as evading taxes, suppressing transactions, or claiming excessive input tax credit.

- Section 67(2): Allows the proper officer to search and seize goods, documents, or other items if they are believed to be concealed or necessary for further investigation. This provision also grants officers the power to temporarily seal premises if it is impracticable to seize the goods or documents.

- Section 67(4): Allows officers to break open doors, almirahs, or other containers if access is denied during the course of a search.

- Rule 139(1) of the CGST Rules:

This rule governs the procedure for inspections and searches under Section 67, using Form GST INS-I for authorizing inspections or searches. In this case, the authorization for search and seizure relied on Rule 139(1), issued by the DGST authorities.

Arguments of the Respondents (DGST Authorities):

- Non-Cooperation by the Petitioner:

The counsel representing the DGST, Mr. Gautam Narayan, argued that despite multiple requests, the petitioner had not cooperated with the authorities. The petitioner had failed to produce the necessary books of accounts and documents, which justified the continued sealing of the premises. - Section 67 Powers:

The DGST authorities relied on Section 67 of the CGST Act to argue that they were within their rights to seal the premises until the petitioner complied with their demands for document production. They claimed that the petitioner’s non-compliance with the inspection orders justified the sealing action.

Court’s Analysis:

- Scope of Section 67:

The court carefully analyzed the provisions of Section 67, particularly subsections (1) and (2), which grant limited powers to tax authorities for inspection, search, and seizure of goods and documents. It emphasized that these powers are intended to secure evidence necessary for investigations or proceedings under the CGST Act but do not extend to the indefinite sealing of premises. - Temporary vs. Indefinite Sealing:

The court noted that while the DGST authorities could temporarily seal premises to secure evidence, they could not use this power to indefinitely prevent the petitioner from accessing their business. The court held that such indefinite sealing, as had occurred in this case, was not supported by the statutory framework of the CGST Act. - Violation of Rights:

The court further held that the continued sealing of the petitioner’s premises for over a month was disproportionate and illegal. It observed that even if the DGST authorities had justified concerns regarding the petitioner’s non-cooperation, their actions exceeded the scope of their legal powers under the CGST Act. - Absence of Clear Authorization:

The court also scrutinized the authorization for search and seizure issued by the DGST under Rule 139(1) in Form GST INS-I. It noted that while the authorization mentioned the petitioner’s premises, it did not specifically name the assessee, raising concerns about the procedural correctness of the DGST’s actions.

Court’s Judgment:

- Sealing Declared Illegal:

The court declared that the indefinite sealing of the petitioner’s premises was illegal and beyond the powers conferred upon the DGST under the CGST Act. - De-Sealing Ordered:

The court directed the DGST authorities to immediately remove the seal from the petitioner’s business premises within 12 hours of the order and return the premises to the petitioner. The court observed that the petitioner’s premises had been under the DGST’s control for over a month, which was unjustified. - Petition Allowed:

In light of the above findings, the court allowed the writ petition, granting relief to the petitioner.

Conclusion:

The Delhi High Court, in its detailed judgment, clarified the limited scope of the DGST’s powers under Section 67 of the CGST Act. It held that while the tax authorities could temporarily seal premises to secure evidence during an investigation, the indefinite sealing of a business premises was illegal and disproportionate. The court ordered the immediate de-sealing of the petitioner’s premises, providing significant relief to M/S Napin Impex Private Ltd.

Read More Insights

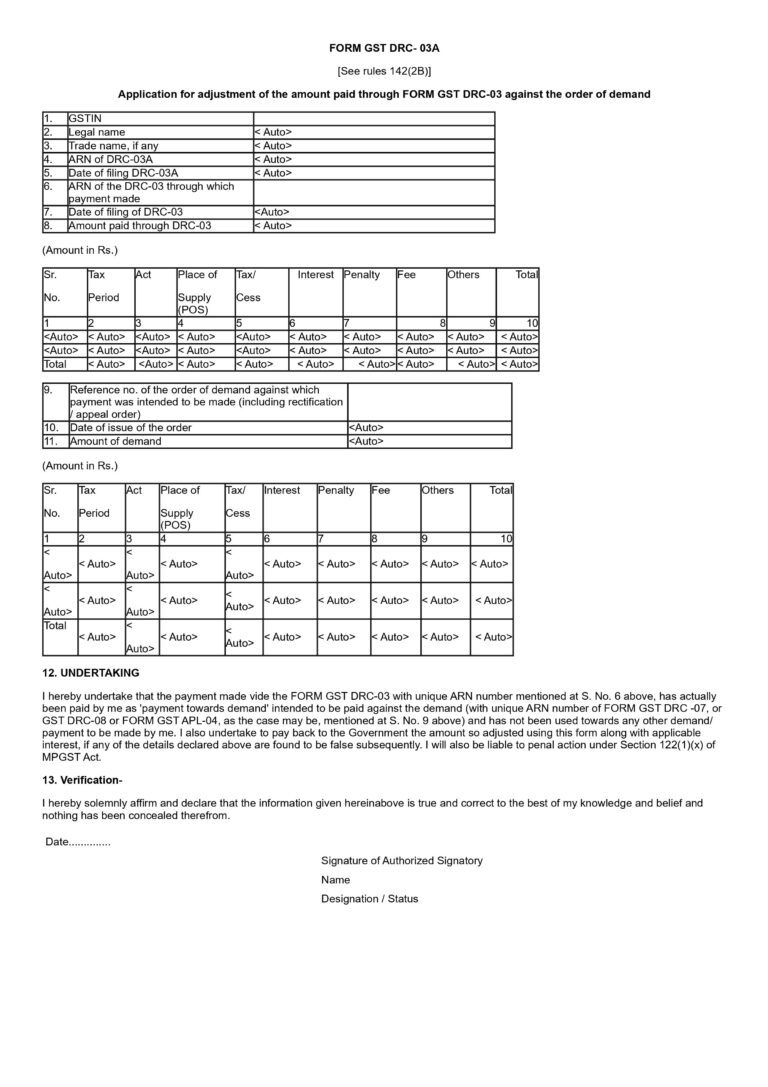

Clarification on GST Payments Through Form GST DRC-03 and Introduction of Form GST DRC-03A

Clarification on GST Payments Through Form GST DRC-03 and Introduction of Form GST DRC-03A Home Insights Clarification on GST Payments Through Form GST DRC-03 and

Manappuram Finance Ltd. vs. Union of India & Ors. – Kerala High Court (29th July 2024)

Manappuram Finance Ltd. vs. Union of India & Ors. – Kerala High Court (29th July 2024) Home Insights Manappuram Finance Ltd. vs. Union of India

Asianet Digital Network Private Ltd vs. The Assistant State Tax Officer – Kerala High Court (29 November, 2018)

Asianet Digital Network Private Ltd vs. The Assistant State Tax Officer – Kerala High Court (29 November, 2018) Home Insights Asianet Digital Network Private Ltd