Ford India Private Limited vs. Deputy Commissioner (ST-III) - Madras High Court Judgment (24 June 2024)

Services

Business Incorporation & Compliance

Registration & Certification Services

GST Advisory & Compliance

Income Tax Advisory & Compliance

Accounting and Payroll Services

Audit & Assurance Services

International Tax Services

UAE Business Services

Financial Insights

Detailed Summary of CBIC Instruction No. 03/2025-GST

Union Budget 2025: Goods and Services Tax Comprehensive Overview

Union Budget 2025: Direct Tax Comprehensive Overview

Detailed Summary of Recommendations from the 54th GST Council Meeting

Court: Madras High Court

Judges: Hon’ble Mr. Justice Senthilkumar Ramamoorthy

Case Number: Writ Petition No. 16090 of 2024

Date: 24 June 2024

Petitioner: Ford India Private Limited, represented by its Authorized Signatory, Mr. K. Sakthivel.

Respondent: Deputy Commissioner (ST-III), Large Taxpayer Unit, Chennai.

This case involves a writ petition filed by Ford India Private Limited, challenging an assessment order dated 18 March 2024, issued by the Deputy Commissioner (ST-III), under the Goods and Services Tax (GST) regime. The petitioner sought to quash the order on the grounds that it was unreasoned and failed to consider the petitioner’s submissions regarding discrepancies between the auto-populated GSTR-2A and the data in Table 8A of the annual return GSTR-9.

Facts of the Case:

- Assessment Period: The dispute pertains to the assessment period for the financial year 2018-19.

- Show Cause Notices: The petitioner received two show cause notices dated 27 December 2023. In response, the petitioner submitted a reply on 25 January 2024, explaining that the input tax credit (ITC) availed was less than the credit available in the auto-populated GSTR-2A form. The petitioner pointed out that the GSTR-2A is dynamic, reflecting ongoing data uploads by suppliers.

- Dropping of Proceedings: Following the petitioner’s reply, proceedings under one of the show cause notices were dropped, but the proceedings under the other notice continued, leading to the issuance of the impugned assessment order on 18 March 2024.

- Grounds of Challenge: The petitioner challenged the assessment order on the basis that it was unreasoned. The order simply extracted the petitioner’s reply and confirmed the tax proposal without providing any justifications or addressing the petitioner’s concerns about the data mismatch.

Contentions of the Petitioner:

- Dynamic Nature of GSTR-2A: The petitioner argued that the GSTR-2A form is dynamic and subject to changes based on ongoing data uploads by suppliers. The petitioner relied on a press release dated 3 July 2019 from the Central Board of Indirect Taxes and Customs (CBIC), which acknowledged that mismatches between the data in Table 8A of GSTR-9 and GSTR-2A are possible due to the dynamic nature of the latter.

- Unreasoned Order: The petitioner contended that the assessment order was arbitrary as it failed to provide any reasoning for the confirmation of the tax demand, especially in light of the detailed explanation provided in the reply.

Contentions of the Respondents:

- Remand for Reconsideration: The respondent, represented by the Government Advocate, suggested that the matter be remanded for reconsideration, allowing the assessing officer to address the mismatch issue properly.

Court’s Findings:

- Lack of Reasoning in the Order: The Madras High Court, presided over by Justice Senthilkumar Ramamoorthy, found that the impugned order was unsustainable as it lacked any reasoning or consideration of the petitioner’s submissions. The Court emphasized that an order without reasons cannot be upheld.

- Remand for Fresh Consideration: The Court set aside the impugned assessment order and remanded the matter to the respondent for reconsideration. The respondent was directed to provide a reasonable opportunity for the petitioner to present its case, including a personal hearing. The Court ordered that a fresh order be issued within three months from the date of receipt of its order.

Conclusion:

The Madras High Court quashed the impugned assessment order dated 18 March 2024, and remanded the matter for fresh consideration by the Deputy Commissioner (ST-III). The respondent was instructed to re-evaluate the case, taking into account the petitioner’s submissions and providing a reasoned order. The Court also ordered the lifting of the bank attachment that had been imposed due to the assessment order.

Read More Insights

Asianet Digital Network Private Ltd vs. The Assistant State Tax Officer – Kerala High Court (29 November, 2018)

Asianet Digital Network Private Ltd vs. The Assistant State Tax Officer – Kerala High Court (29 November, 2018) Home Insights Asianet Digital Network Private Ltd

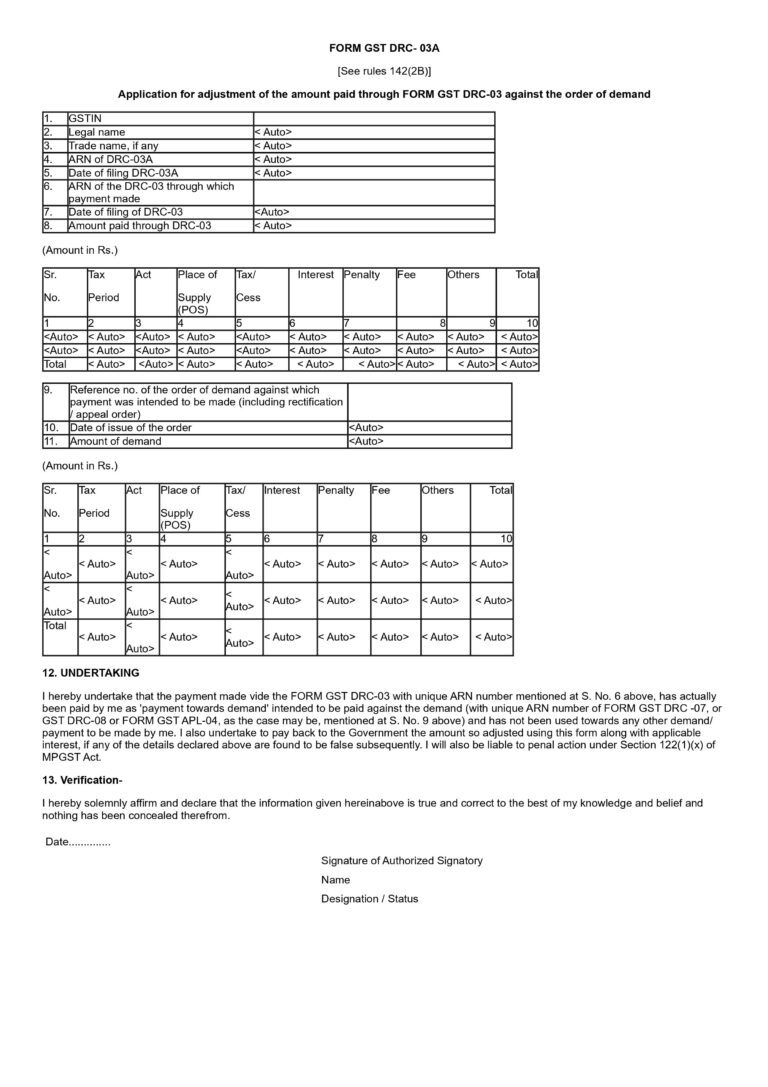

Clarification on GST Payments Through Form GST DRC-03 and Introduction of Form GST DRC-03A

Clarification on GST Payments Through Form GST DRC-03 and Introduction of Form GST DRC-03A Home Insights Clarification on GST Payments Through Form GST DRC-03 and

Standard Chartered Bank vs. The Principal Commissioner Of Central Tax & Others – Telangana High Court Judgment (11 July 2024)

Standard Chartered Bank vs. The Principal Commissioner Of Central Tax & Others – Telangana High Court Judgment (11 July 2024) Home Insights Standard Chartered Bank