Standard Chartered Bank vs. The Principal Commissioner Of Central Tax & Others - Telangana High Court Judgment (11 July 2024)

Services

Business Incorporation & Compliance

Registration & Certification Services

GST Advisory & Compliance

Income Tax Advisory & Compliance

Accounting and Payroll Services

Audit & Assurance Services

International Tax Services

UAE Business Services

Financial Insights

Detailed Summary of CBIC Instruction No. 03/2025-GST

Union Budget 2025: Goods and Services Tax Comprehensive Overview

Union Budget 2025: Direct Tax Comprehensive Overview

Detailed Summary of Recommendations from the 54th GST Council Meeting

Union Budget 2025: Goods and Services Tax Comprehensive Overview

Detailed Summary of Recommendations from the 54th GST Council Meeting

Court: Telangana High Court

Judges: The Hon’ble Sri Justice Sujoy Paul and The Hon’ble Sri Justice Namavarapu Rajeshwar Rao

Case Number: Writ Petition No. 648 of 2024

Date: 11 July 2024

Petitioner: M/s. Standard Chartered Bank, represented by Senior Counsel Sri Lakshmi Kumaran Sridharan.

Respondents: The Principal Commissioner of Central Tax & Others, represented by Senior Counsel Sri B. Narayan Reddy.

This case revolves around the issue of whether M/s. Standard Chartered Bank, which is registered under the Goods and Services Tax (GST) regime in Maharashtra, but due to technical issues filed a GST return in Telangana, can be subjected to demands for payment, penalty, and interest by the GST authorities. The bank transferred the credit to the Maharashtra GST portal on the same day it filed the return in Telangana.

Facts of the Case:

- Centralized Registration in Maharashtra: Standard Chartered Bank has its headquarters in Mumbai, Maharashtra, and holds centralized registration under both the Service Tax regime and the GST Act, 2017.

- Filing of GST Returns: On 18 October 2017, the bank encountered a technical glitch while attempting to file its GST return on the Maharashtra GST portal. Due to the impending deadline, the bank filed its return on the Telangana GST portal, where it has a branch, and immediately transferred the credit amount of ₹1,41,26,69,646 to the Maharashtra GST portal.

- Pre-Show Cause Notice: On 3 September 2021, the bank received a pre-show cause notice alleging that the credit claimed in Telangana was ineligible and should be reversed along with applicable interest and penalties. The bank responded promptly, clarifying that the credit was transferred to the Maharashtra portal on the same day and that only a small differential balance of ₹2,00,000 was left in Telangana.

- Show Cause Notice: On 29 December 2021, the respondents issued a formal show cause notice, to which the bank replied, defending its actions and pointing out that the transition credit was transferred to Maharashtra on the same day. The bank argued that there was no prohibition in the GST Act against filing returns in a state where a branch exists if there are compelling circumstances.

- Impugned Order: The respondent authority passed an Order-in-Original on 31 October 2023, confirming the demand for ₹1,41,26,69,646, along with interest and penalty, under Section 140 of the CGST Act, 2017.

Contentions of the Petitioner:

- Technical Glitch Justification: The bank’s counsel argued that the return was filed in Telangana due to technical difficulties in Maharashtra’s GST portal. The return was filed before the due date, and the credit was transferred to Maharashtra on the same day, hence there was no loss to the revenue, and no undue benefit was derived by the bank.

- No Prohibition Under GST Act: Counsel contended that under Section 140(1) and (8) of the GST Act, there is no explicit prohibition against filing a return in a different state where a branch exists, especially under such circumstances. The respondents’ interpretation of the law was claimed to be overly restrictive and incorrect.

- Pure Question of Law: The petitioner asserted that the case involves a pure question of law regarding the interpretation of Section 140 of the GST Act, and hence, the High Court should entertain the writ petition directly, instead of relegating the petitioner to the statutory remedy of appeal.

Contentions of the Respondents:

- Alternative Remedy Argument: The respondents raised a preliminary objection, arguing that the petitioner should have availed the alternative remedy of an appeal as provided under Section 107 of the GST Act. However, they acknowledged that the core issue was indeed a question of law.

- Filing in Maharashtra Portal: The respondents maintained that since the petitioner’s centralized registration was in Maharashtra, the return should have been filed in the Maharashtra GST portal. They argued that even if there was a technical glitch, the petitioner should have sought redressal within Maharashtra’s GST jurisdiction rather than filing in Telangana.

Court’s Findings:

- Jurisdiction and Maintainability: The Court held that the writ petition was maintainable as it involved a pure question of law, following the principles laid down in the Supreme Court judgments in M/s. Godrej Sara Lee Ltd. vs. Excise and Taxation Officer-cum-Assessing Authority & Others and Chandrapur Magnet Wires (P) Ltd. vs. Collector of Central Excise, Nagpur. The Court reasoned that when the issue is purely legal and does not involve disputed facts, it is appropriate for the High Court to decide the matter.

- Section 140 of the GST Act: The Court meticulously examined Section 140 of the GST Act. It noted that Section 140(1) allows a registered person to take credit in their electronic credit ledger of the CENVAT credit carried forward in the return filed under the previous law (Service Tax), provided that the PAN is the same. The Court found no explicit restriction in the Act that mandates filing returns only in the state of centralized registration if there are valid reasons, such as a technical glitch.

- Propriety of the Respondent’s Actions: The Court criticized the respondent’s rigid interpretation of the law, noting that the petitioner did not gain any unfair advantage nor did the revenue suffer a loss. The Court observed that the technical issue in Maharashtra’s portal was acknowledged by the respondents themselves, and therefore, penalizing the petitioner for filing in Telangana was unwarranted.

Conclusion:

The Telangana High Court ruled in favour of M/s. Standard Chartered Bank, setting aside the impugned order passed by the respondent authority. The Court held that the petitioner acted within the law by filing the return in Telangana due to technical difficulties and immediately transferring the credit to Maharashtra. The respondents’ demand for the return of credit, along with interest and penalties, was deemed unjustified and was quashed.

Read More Insights

Detailed Summary of CBIC Instruction No. 03/2025-GST

Guidelines for Streamlined Processing of GST Registration Applications – Issued on 17th April 2025 by the GST Policy Wing, CBIC Home Insights Guidelines for Streamlined

Air Transport Corporation (Assam) Pvt. Ltd. vs. State of U.P. & 3 Others – Allahabad High Court (5 January, 2018)

Air Transport Corporation (Assam) Pvt. Ltd. vs. State of U.P. & 3 Others – Allahabad High Court (5 January, 2018) Home Insights Air Transport Corporation

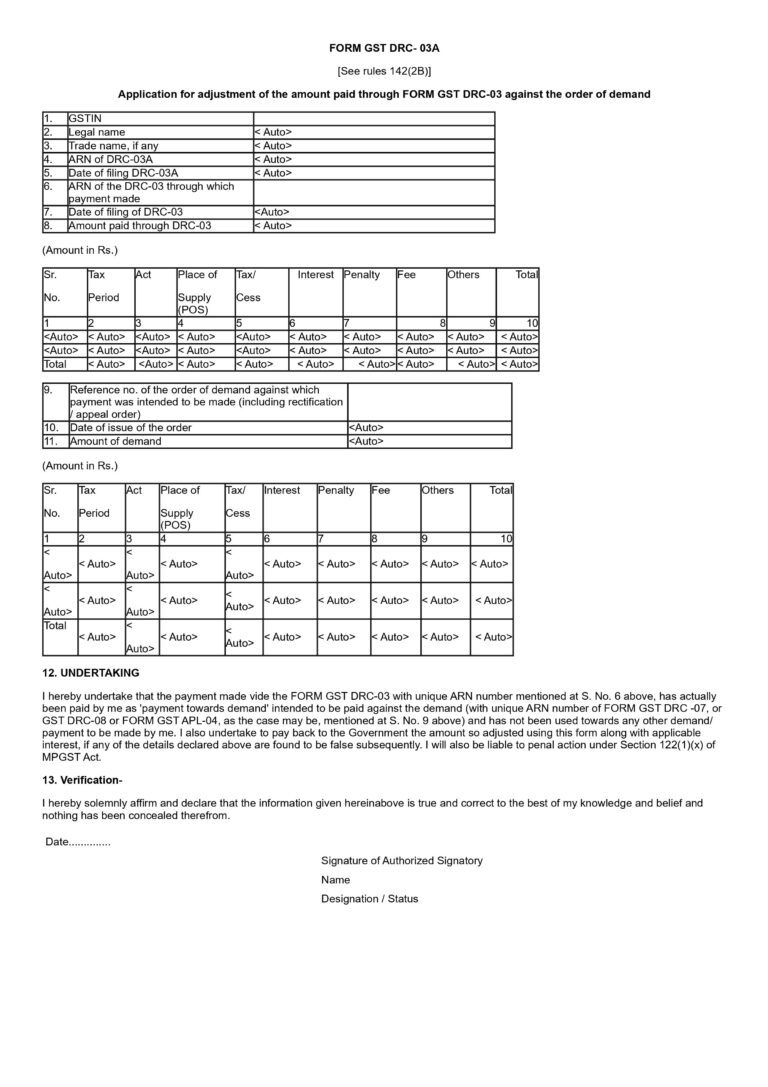

Clarification on GST Payments Through Form GST DRC-03 and Introduction of Form GST DRC-03A

Clarification on GST Payments Through Form GST DRC-03 and Introduction of Form GST DRC-03A Home Insights Clarification on GST Payments Through Form GST DRC-03 and