Services

Business Incorporation & Compliance

Registration & Certification Services

GST Advisory & Compliance

Income Tax Advisory & Compliance

Accounting and Payroll Services

Audit & Assurance Services

International Tax Services

UAE Business Services

Financial Insights

Detailed Summary of CBIC Instruction No. 03/2025-GST

Union Budget 2025: Goods and Services Tax Comprehensive Overview

Union Budget 2025: Direct Tax Comprehensive Overview

Detailed Summary of Recommendations from the 54th GST Council Meeting

Detailed Summary of CBIC Instruction No. 03/2025-GST

Detailed Summary of Recommendations from the 54th GST Council Meeting

Detailed Summary of CBIC Instruction No. 03/2025-GST

Guidelines for Streamlined Processing of GST Registration Applications – Issued on 17th April 2025 by the GST Policy Wing, CBIC Home Insights Guidelines for Streamlined

Union Budget 2025: Goods and Services Tax Comprehensive Overview

Union Budget 2025: Goods and Services Tax Comprehensive Overview Home Insights Union Budget 2025: Goods and Services Tax Comprehensive Overview Services Business Incorporation & Compliance

Union Budget 2025: Direct Tax Comprehensive Overview

Union Budget 2025: Direct Tax Comprehensive Overview Home Insights Union Budget 2025: Direct Tax Comprehensive Overview Services Business Incorporation & Compliance Company Registration LLP Registration

Detailed Summary of Recommendations from the 54th GST Council Meeting

Detailed Summary of Recommendations from the 54th GST Council Meeting Home Insights Detailed Summary of Recommendations from the 54th GST Council Meeting Services Business Incorporation

Air Transport Corporation (Assam) Pvt. Ltd. vs. State of U.P. & 3 Others – Allahabad High Court (5 January, 2018)

Air Transport Corporation (Assam) Pvt. Ltd. vs. State of U.P. & 3 Others – Allahabad High Court (5 January, 2018) Home Insights Air Transport Corporation

Napin Impex Private Ltd. vs. Commissioner of DGST, Delhi & Ors. – Delhi High Court (28 September, 2018)

Napin Impex Private Ltd. vs. Commissioner of DGST, Delhi & Ors. – Delhi High Court (28 September, 2018) Home Insights Napin Impex Private Ltd. vs.

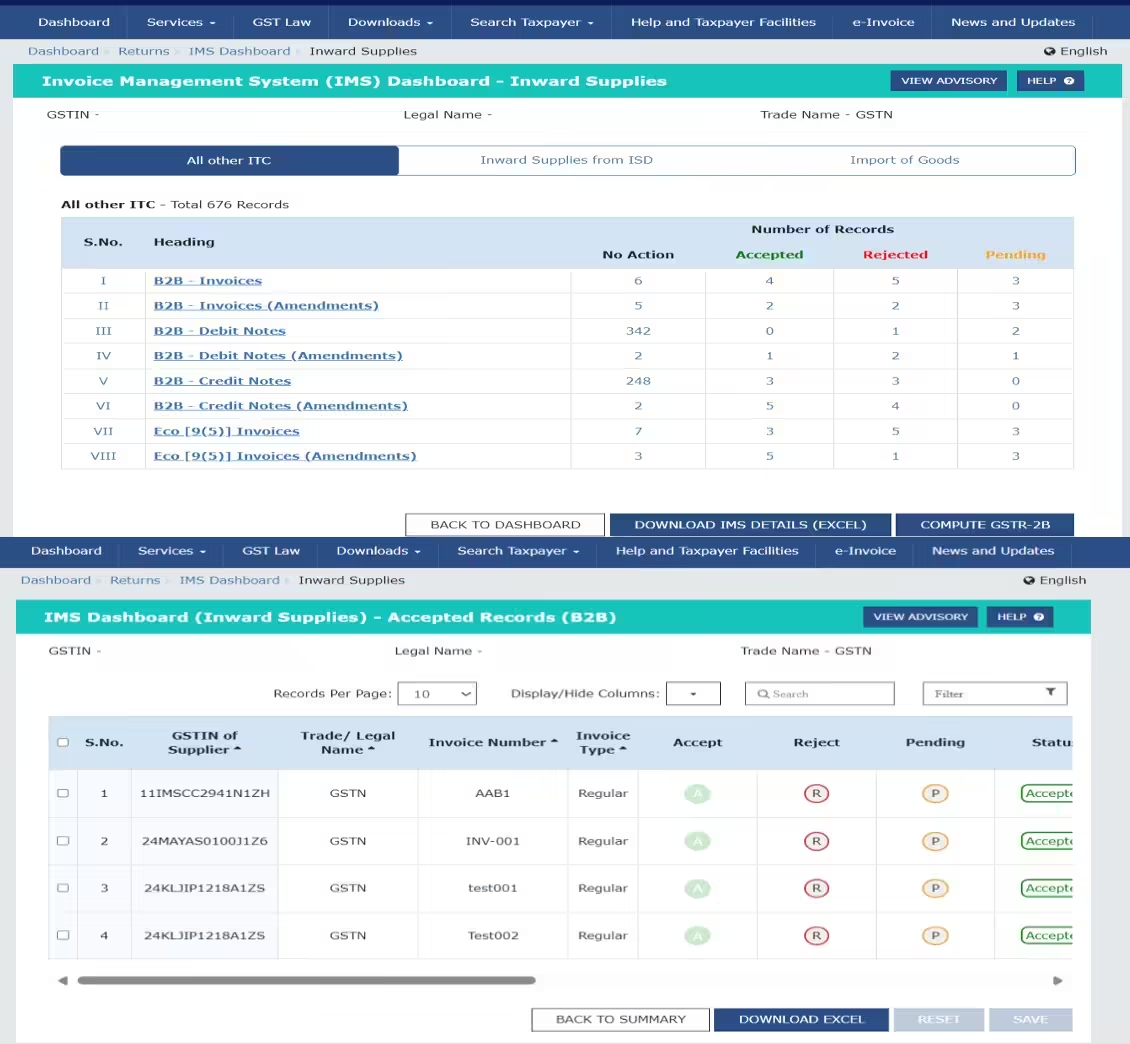

Invoice Management System (IMS) for Efficient GST Input Tax Credit (ITC) Management

Invoice Management System (IMS) for Efficient GST Input Tax Credit (ITC) Management Home Insights Invoice Management System (IMS) for Efficient GST Input Tax Credit (ITC)

Asianet Digital Network Private Ltd vs. The Assistant State Tax Officer – Kerala High Court (29 November, 2018)

Asianet Digital Network Private Ltd vs. The Assistant State Tax Officer – Kerala High Court (29 November, 2018) Home Insights Asianet Digital Network Private Ltd

Tvl.Vibis Natural Bee Farms vs. The Deputy State Tax Officer – Madras High Court (26 July, 2024)

Tvl.Vibis Natural Bee Farms vs. The Deputy State Tax Officer – Madras High Court (26 July, 2024) Home Insights Tvl.Vibis Natural Bee Farms vs. The

Novozymes South Asia Pvt. Ltd. vs. Joint Commissioner of State Goods and Services Tax & Ors. – Gujarat High Court (1st August 2024)

Novozymes South Asia Pvt. Ltd. vs. Joint Commissioner of State Goods and Services Tax & Ors. – Gujarat High Court (1st August 2024) Home Insights