Services

Business Incorporation & Compliance

Registration & Certification Services

GST Advisory & Compliance

Income Tax Advisory & Compliance

Accounting and Payroll Services

Audit & Assurance Services

International Tax Services

UAE Business Services

Financial Insights

Detailed Summary of CBIC Instruction No. 03/2025-GST

Union Budget 2025: Goods and Services Tax Comprehensive Overview

Union Budget 2025: Direct Tax Comprehensive Overview

Detailed Summary of Recommendations from the 54th GST Council Meeting

Manappuram Finance Ltd. vs. Union of India & Ors. – Kerala High Court (29th July 2024)

Manappuram Finance Ltd. vs. Union of India & Ors. – Kerala High Court (29th July 2024) Home Insights Manappuram Finance Ltd. vs. Union of India

Cart Infralog Limited & Anr vs. The Assistant Commissioner of CGST & Ors. – Calcutta High Court Judgment (29 July 2024)

Cart Infralog Limited & Anr vs. The Assistant Commissioner of CGST & Ors. – Calcutta High Court Judgment (29 July 2024) Home Insights Cart Infralog

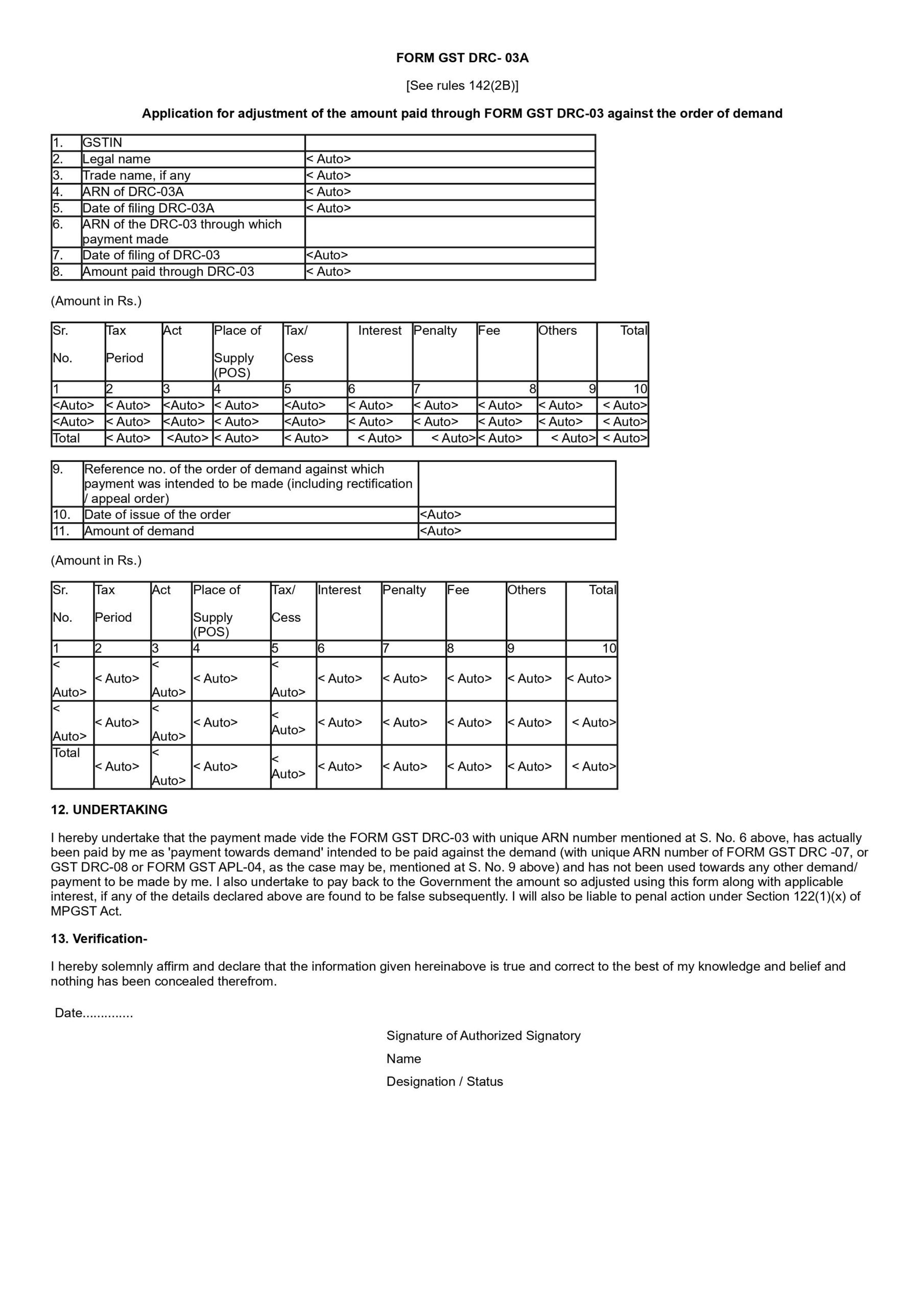

Clarification on GST Payments Through Form GST DRC-03 and Introduction of Form GST DRC-03A

Clarification on GST Payments Through Form GST DRC-03 and Introduction of Form GST DRC-03A Home Insights Clarification on GST Payments Through Form GST DRC-03 and

Ford India Private Limited vs. Deputy Commissioner (ST-III) – Madras High Court Judgment (24 June 2024)

Ford India Private Limited vs. Deputy Commissioner (ST-III) – Madras High Court Judgment (24 June 2024) Home Insights Ford India Private Limited vs. Deputy Commissioner

Standard Chartered Bank vs. The Principal Commissioner Of Central Tax & Others – Telangana High Court Judgment (11 July 2024)

Standard Chartered Bank vs. The Principal Commissioner Of Central Tax & Others – Telangana High Court Judgment (11 July 2024) Home Insights Standard Chartered Bank