Union Budget 2025: Direct Tax Comprehensive Overview

Services

Business Incorporation & Compliance

Registration & Certification Services

GST Advisory & Compliance

Income Tax Advisory & Compliance

Accounting and Payroll Services

Audit & Assurance Services

International Tax Services

UAE Business Services

Financial Insights

Detailed Summary of CBIC Instruction No. 03/2025-GST

Union Budget 2025: Goods and Services Tax Comprehensive Overview

Union Budget 2025: Direct Tax Comprehensive Overview

Detailed Summary of Recommendations from the 54th GST Council Meeting

Union Budget 2025: Direct Tax Comprehensive Overview

Detailed Summary of CBIC Instruction No. 03/2025-GST

The Union Budget 2025 brings significant changes to India’s tax landscape, introducing revised income tax slabs, updates to TDS/TCS thresholds, enhanced exemptions, and critical reforms across various sectors like crypto taxation, international finance, and start-up incentives. This comprehensive guide delves into all key proposals, from salary perks and capital gains revisions to penalties and international taxation policies. Whether you’re an individual taxpayer, business owner, or investor, this article provides an in-depth analysis of the budget’s impact and opportunities for strategic financial planning.

CHANGES IN TAX RATES

- With effect from AY 2026-27 the following will be the new tax slab and rate on total income of individual / HUF / AOP / BOI under the new tax regime [S. 115BAC (1A)] of Income Tax as compared to previous assessment year:

|

FY 2025-26 / AY 2026-27 |

FY 2024-25 / AY 2025-26 |

||

|

Total Income |

Tax Rate (%) |

Total Income |

Tax Rate (%) |

|

Up to 4,00,000 |

0 |

Up to 3,00,000 |

0 |

|

4,00,001 to 8,00,000 |

5 |

3,00,001 to 7,00,000 |

5 |

|

8,00,001 to 12,00,000 |

10 |

7,00,001 to 10,00,000 |

10 |

|

12,00,001 to 16,00,000 |

15 |

10,00,001 to 12,00,000 |

15 |

|

16,00,001 to 20,00,000 |

20 |

12,00,001 to 15,00,000 |

20 |

|

20,00,001 to 24,00,000 |

25 |

Above 15,00,000 |

30 |

|

Above 24,00,000 |

30 | ||

Notes:

- Rebate u/s 87A under the new tax regime has been increased from Rs 25,000 to Rs 60,000.

- Rebate u/s 87A would not be applicable to special rate taxes for e.g., section 112, 112A, 111, etc.

TAX DEDUCTED & COLLECTED AT SOURCE

- Change in TDS / TCS Rate

|

Section |

Nature of Payment |

Existing Rate Upto 31.03.2025 |

Proposed Rate From 01.04.2025 |

|

194 LBC |

Income in respect of investment in Securitization Trust |

25% (Individual/ HUF) 30% (Other Persons) |

10% |

|

206C(1) |

(i) TCS on timber or any other forest produce (not being tendu leaves) obtained under a forest lease and (ii) TCS on timber obtained by any mode other than under a forest lease |

2.5% |

2% |

|

206C(1G) |

TCS on remittance under LRS for purpose of education, financed by loan from financial institution |

0.5% after 7 lakhs |

Nil |

- Changes in Threshold to deduct TDS/TCS

|

Section |

Nature of Payment |

Existing Threshold Upto 31.03.2025 |

Proposed Threshold From 01.04.2025 |

|

193 |

Interest on Securities |

NIL |

10,000 |

|

194 |

Dividends |

5,000 |

10,000 |

|

194 B |

Winnings from lottery or crossword puzzle |

10,000 (Aggregate of amounts during the FY) |

10,000 (Limit per Transaction) |

|

194 BB |

Winnings from horse race |

10,000 (Aggregate of amounts during the FY) |

10,000 (Limit per Transaction) |

|

194 D |

Insurance Commission |

15,000 |

20,000 |

|

194 G |

Commission, etc., on sale of lottery tickets |

15,000 |

20,000 |

|

194 H |

Commission or Brokerage |

15,000 |

20,000 |

|

194 I |

Rent |

2,40,000 (For full year) |

50,000 (Per month or part of month) |

|

194 J |

Fees for professional or technical services |

30,000 |

50,000 |

|

194 K |

Income in respect of units |

5,000 |

10,000 |

|

194 LA |

Payment of compensation on acquisition of certain immovable property |

2,50,000 |

5,00,000 |

|

206C(1G) |

TCS on Remittance under LRS and overseas tour program package |

7,00,000 |

10,00,000 |

- Section 194A – Interest other than interest on securities (w.e.f. 01.04.2025

|

S. No |

Payer |

For Other Persons |

For Senior Citizens |

||

|

Current threshold |

Proposed threshold |

Current threshold |

Proposed threshold |

||

|

1. |

Banking Companies |

40,000 |

50,000 |

50,000 |

1,00,000 |

|

2. |

Co-operative bank |

40,000 |

50,000 |

50,000 |

1,00,000 |

|

3. |

Any Deposit with Post office |

40,000 |

50,000 |

50,000 |

1,00,000 |

|

4. |

Any Other Case |

5,000 |

10,000 |

5,000 |

10,000 |

|

5. |

Cooperative society referred to in clause (v) and clause (viia) of section 194A(3) |

40,000 |

50,000 |

50,000 |

1,00,000 |

- TCS u/s 206C (1) amended to reduce the TCS rate from 2.5% to 2% on:

- Timber or any other forest produce (excluding tendu leaves) obtained under a forest lease

- Timber obtained by any mode other than under a forest lease

Now Forest produce obtained under a forest lease only would be covered under TCS, as the item ‘any other forest produce not being timber or tendu leaves’ is omitted.

- Earlier the term “forest produce” was not defined in the Income Tax Act. Now, “forest produce” shall have the same meaning as defined in:

- Any State Act in force, or

- The Indian Forest Act, 1927

- Section 206C (1H) is being omitted. Hence, TCS will no longer be applicable on the sale of goods exceeding Rs. 50 lakh and only TDS under Section 194Q will apply.

- Sections 206AB and 206CCA have been omitted hence, TDS and TCS will no longer be applied at higher rates for non-filers of ITR

- Proviso inserted to section 206C(7A). Currently no order can be passed against a person as an assessee in default for non-payment of TCS after:

- 6 years from the end of the financial year in which the tax was collectible; or

- 2 years from the end of the financial year in which a correction statement is filed u/s 206C(3B)

whichever is later

As per the proviso to be inserted, while computing such time limits, period of stay granted by an order of any court and ending on the date on which certified copy of order vacating the stay is received by jurisdictional Pr. CIT or CIT shall be excluded, hence tax authorities would get sufficient time to complete proceedings after the stay is lifted.

(w.e.f. 1st April 2025)

EXEMPTIONS & DEDUCTIONS

- Section 80CCA is being amended to provide tax relief to individuals withdrawing funds from the National Savings Scheme (NSS) since no interest would be paid on NSS balances from October 1, 2024. The amendment would exempt withdrawals made on or after August 29, 2024, for deposits made before April 1, 1992, which had previously qualified for a tax deduction.

(With retrospective effect from August 29, 2024)

- The following benefits which are already available to NPS Contribution u/s 80CCD would now be extended to NPS Vatsalya Scheme.

- Deduction to be allowed to parents/ guardian’s maximum upto Rs 50,000/-.

- Where the deduction has earlier been claimed under this section and this amount is subsequently withdrawn, will be charged to tax when such amount is withdrawn.

- In case of the minor’s death, the withdrawal amount isn’t taxed as the guardian’s income.

Where there is a partial withdrawal for education, medical treatment, or disability of Minor Child, the tax exemptions on partial withdrawals shall not be included in the total income of the parent/guardian to the extent it does not exceed 25% of the amount of contributions made by him.

(w.e.f. 1st April 2026)

- Section 80-IAC is being amended to extend the benefit of deduction for another period of 5 years for start-ups incorporated before 01.04.2030. Earlier this deduction is available for Start-ups incorporated before 01.04.2025.

- Section 10(23FE) to be amended to exempt long term capital gain (whether or not such capital gains are treated as short term capital gains u/s 50AA) arising from investment by Sovereign Wealth Funds and Pension Funds made in India. Further the date of investment shall be extended from 31st March 2025 to 31st March 2030.

(w.e.f. 1st April 2025)

CHARITABLE TRUSTS

- It is proposed that for the trusts and institutions registered u/s 12A (1) (ac) (i to v) and whose total income of each of 2 years does not exceeds Rs. 5 crores, preceding to the previous year in which such application is made, the period of validity of registration is extended from 5 to 10 years.

- Explanation to section 12AB (4) amended to clarify that an incomplete application will not be treated as a specified violation for cancellation of registration.

- Section 13 of the Act excludes income from the trust or institution if it benefits certain individuals, including those who have made substantial contributions (over Rs. 50,000 in aggregate in lifetime of the trust), their relatives, or concerns in which they have a substantial interest. It is proposed that the following categories of substantial contributors shall be treated as persons specified u/s 13:

- Persons making substantial contributions will be those whose total contribution exceeds Rs. 1 lakh in the relevant year or Rs. 10 lakh cumulatively

- Relatives of these contributors will not be included in the specified persons under section 13.

- Concerns in which such persons have a substantial interest will also not be included in the specified persons u/s 13.

(w.e.f. 1st April 2025)

SALARIES

- It is proposed u/s 17(2), that if the salary exceeds the prescribed limit, only then the benefits would be treated as perquisite and will be taxable under head salary.

|

Aspect |

Current Limit |

Proposed Limit |

|

Benefits or amenity granted or provided free of cost or at concessional rate |

50,000 |

Limit as may be prescribed |

|

Medical travel expense for employee or his family outside India |

200,000 |

(w.e.f. 1st April 2026)

HOUSE PROPERTY

- It is proposed to amend section 23(2), to provide that the annual value of 2nd self-occupied house property will be taken as nil, if the 2nd house property could not be occupied due to any reason. Earlier the reason for not occupying the 2nd house property was mentioned as due to employment, business or profession carried on at any other place.

(w.e.f. 1st April 2025)

CAPITAL GAINS

- The rates for tax payable on Long Term capital gain derived from the transfer of securities other than equity share in a company or a unit of an equity-oriented fund or a unit of a business trust u/s 115AD have been increased from 10% to 12.5%.

- Section 2(14) amended to clarify that securities held by investment funds u/s 115UB (AIFs) are capital assets, and consequently income from their transfer would be treated as capital gains from AY 2026-27

- The provisions of section 115UA shall now also include Section 112A apart from Section 111A and 112 for the purpose of taxation of business trusts (InvIT & REIT) at lower rates in case of income arises from Capital Gains. Other Incomes are taxable at maximum marginal rates.

- Income on redemption of Unit Linked Insurance Policy would be treated as Capital Gains and following clarifications have been made:

- ULIPs which are not exempt u/s 10(10D) shall be treated as a Capital Asset

- The income arising from the redemption of ULIPs on which the exemption of Section 10(10D) does not apply are taxable as Capital Gain u/s 45

- For the purpose of clause (a) of Explanation to section 112A, the definition of equity-oriented funds shall also include ULIPs on which the exemption u/s 10(10D) is not applicable.

RETURNS, ASSESSMENT & APPEALS

- Now the updated Return can be filed upto 4 years instead of 2 years. The following table summarizes the proposed amendments and conditions for filing updated returns u/s 139(8A).

|

Time Period |

Rate of Additional tax |

|

Upto 12 months from the end of the relevant AY |

25% |

|

After expiry of 12 months and upto 24 months |

50% |

|

After expiry of 24 months and upto 36 months |

60% |

|

After expiry of 36 months and upto 48 months |

70% |

|

Post 36 months (If notice under Section 148A issued) |

Updated return cannot be filed* |

*However, if an order is passed stating that no notice under Section 148 is required, an updated return can be filed within post 36 months but upto 48 months.

- Currently in search cases, approval for retention of seized books or documents u/s 132(8) must be sought within 30 days from the date of assessment or reassessment orders. In group search cases, the timing of assessments and segregation of seized documents can be challenging, leading to a complex and burdensome process for Assessing Officers. The time limit for obtaining approval for retention of seized documents will be extended to one month from the end of the quarter in which the assessment, reassessment, or recomputation order is passed.

- Section 144C provides a special dispute resolution mechanism for certain taxpayers, like foreign companies and those with international transactions, to settle tax disputes efficiently. Faceless schemes were introduced under Sec 144C, with the deadline to notify them initially set for March 31, 2024, and later extended to March 31, 2025. The proposal now is to remove the deadline, allowing the central government to implement faceless schemes even after March 31, 2025, if needed.

- Changes in Block Assessment Introduced in Finance Act, 2024 effective from 01.09.2024

-

- Block assessment will apply to cases where a search U/s 132 or requisition u/s 132A is conducted on or after September 1, 2024.

- The definition of undisclosed income in Sec 158B is expanded to include virtual digital assets (e.g., cryptocurrency).

- Any pending assessment, reassessment, recomputation, reference, or order on the date of search will be abated (cancelled). If the block assessment is annulled in appeal, these abated proceedings will revive (restart). (Sec 158BA)

- In case of a second search while the first assessment is ongoing, the earlier assessment must be completed first. The word “pending” is replaced with “required to be made” for clarity. (Sec 158BA(4))

- The term “total income disclosed” is replaced with “undisclosed income” in Sec 158BB to ensure only undisclosed income is taxed separately.

- Income declared in regular tax returns (before search) will be included in the block period but will get due credit while calculating tax.

- Income for the previous year (where the return due date has not expired before search) will be taxed under normal provisions, ensuring proper assessment.

- International and specified domestic transactions will be excluded from block assessment, as their valuation requires a full financial year for accurate computation

- The time limit for completing a block assessment is now 12 months from the end of the quarter (instead of the month) in which the last authorization of search/requisition was executed.

(w.e.f. 1st February 2025)

- Section 253 which deals with appeals to the Appellate Tribunal and allows the Central Government to introduce a faceless scheme. Currently, the government cannot issue any directions under this section after 31st March 2025, this deadline has been removed allowing flexibility to make changes even after this date.

- Section 255 deals with the constitution and functioning of the Income Tax Appellate Tribunal (ITAT) and allows the Central Government to modify or exclude certain provisions of the Act to implement a faceless scheme. The rule previously stated that these changes couldn’t be made after 31st March 2025 but now this deadline has been removed giving the government more flexibility to make changes even after that date.

(w.e.f. 1st April 2025)

CARRY FORWARD AND SET OFF OF LOSSES

- Sections 72A and 72AA are being amended which deal with the carry- forward and set-off of accumulated losses and unabsorbed depreciation in cases of business amalgamation or reorganization. Currently, accumulated losses of the predecessor entity can be carried forward by the successor entity. However, to prevent indefinite carry forward of these losses through successive amalgamations, the proposed amendment will limit the carry forward period to 8 assessment years from the year the loss was first calculated for the predecessor for amalgamation or business reorganization effected on or after 1st April 2025.

(w.e.f. 1st April 2026)

PENALTIES

- Section 270AA of the Act allows taxpayers to apply for immunity (protection) from penalties under certain conditions, pay the taxes due and file a valid declaration. Earlier, a taxpayer had to apply for immunity within 1 month of receiving an order, and the Assessing Officer had one month to decide. Now, the deadline for the Assessing Officer to process the application is extended to 3 months.

- Section 271AAB of the Income Tax Act currently applies a penalty for undisclosed income found during searches initiated after December 15, 2016. It has been clarified that penalty provisions u/s 271AAB will not apply to Block Assessments initiated on or after September 1, 2024.

(w.e.f. 1st September 2024)

- Currently, penalties u/ss 271C, 271CA (Failure to deduct or collect tax at source), 271DA (S. 269 ST violation), 271DB (S. 269 SU – electronic mode), 271D & 271E (Accepting or repaying loans in cash exceeding legal limits) are imposed by the Joint Commissioner, even though the Assessing Officer handles the assessment. From now on, the Assessing Officer will be responsible for imposing penalties under these sections, instead of the Joint Commissioner. However, if the penalty amount exceeds a certain limit, the Assessing Officer will need to get approval from the Joint Commissioner before imposing the penalty [in accordance with Section 274(2)]

(w.e.f. 1st April 2025)

- Section 271BB deals with penalties for failing to subscribe to eligible capital issues. However, this section is outdated because the related Section 88A has been removed since 1996. Since Section 88A no longer exists, Section 271BB will be removed because it no longer serves any purpose.

(w.e.f. 1st April 2025)

- Section 275 is being substituted to provide that penalties shall be imposed under this section within six months from the end of the quarter in which the legal process (appeal or review) is completed.

(w.e.f. 1st April 2025)

- Currently, if someone fails to pay the tax collected at source (TCS) on time, they may currently be penalized with rigorous imprisonment u/s 276BB. After the change is implemented, there will be no prosecution if the tax is paid before the due date for filing the quarterly statement.

(w.e.f. 1st April 2025)

INTERNATIONAL TAXATION

- Section 9 of the Act deems certain income to accrue or arise in India. Clause (i) specifies that income arising from a business connection in India is deemed to arise in India. Explanation 1 to Clause (i) excludes income of a non-resident from operations confined to purchasing goods in India for export. Explanation 2A defines “significant economic presence” as a business connection, including transactions involving goods between a non-resident and any person in India. Concerns were raised that this definition might override the exclusion for export-related transactions. To resolve this, it is proposed to amend Explanation 2A of section 9, ensuring that transactions limited to purchasing goods for export will not be considered significant economic presence, aligning with the existing exclusion for such operations.

(w.e.f. 1st April 2026)

- Section 44BBD is to be introduced for presumptive tax for non-residents providing services or technology, to a resident company operating in electronics manufacturing facility or other connected services, where 25% of the total amount received by non-residents for these services shall be considered as income.

(w.e.f. 1st April 2026)

- Section 92CA of the Act has been amended to provide an option to the assessee for Arm’s Length Price (ALP) determination in relation to an international transaction or a specified domestic transaction for any previous year, the assessee shall apply to the similar transaction for the 2 consecutive previous years immediately following such previous year in the form or manner as prescribed. The TPO shall within 1 month from the date of exercising the option shall declare the option as valid.

If the option exercised by the assessee is declared as valid by the TPO, then:

- The ALP set for an international or specified domestic transaction in 1 previous year will also apply to similar transactions for the next two previous years immediately following such previous year.

- TPO shall examine and determine the ALP for the above-mentioned transactions for the consecutive years in the order passed by him

- After the order is received, the total taxable income shall be recomputed by the TPO as per Section 155(21).

- A new sub section is being added to S 155 to allow changes in total income when the Transfer Pricing Officer (TPO) accepts the method used by the taxpayer to calculate the Arm’s Length Price (ALP) for two years in a row.

- If the TPO agrees with the taxpayer’s method for two consecutive years, the Assessing Officer (AO) must recalculate the total income for those years by:

-

-

- Following the ALP set by the TPO u/s 92CA(4A).

- Considering any directions given u/s 144C(5).

-

-

- The AO must complete this recalculation within three months from the end of the month in which the original assessment was completed.

- If no assessment order or tax intimation was issued within that time, then the AO still has three months from when it is finally issued to complete the recomputation.

- The recalculation must follow the same transfer pricing rules mentioned in S. 92C(4).

- Once the Arm’s Length Price (ALP) is determined, no further reference for its computation will be made. If a reference is still made (before or after the TPO’s declaration), it will be treated as if it was never made, as per Section 92CA(1).

The option to apply the above provisions and any related proceedings will not apply to search cases.

(w.e.f. 1st April 2026)

INTERNATIONAL FINANCIAL SERVICES CENTRE (IFSC)

- Section 10(4E) currently exempts income of non-residents from the transfer of nondeliverable forward contracts, offshore derivatives, or income from such instruments with an offshore banking unit in the IFSC. It is proposed to extend the exemption to income from such transactions entered into with Foreign Portfolio Investors (FPIs) in an IFSC unit, subject to certain conditions.

(w.e.f. 1st April 2026)

- Sunset dates extended for several tax concessions pertaining to IFSC

|

Section |

Existing Date |

Proposed Date |

|

Section 80LA(2)(d) -Deductions in respect of certain incomes of Offshore Banking Units and IFSC |

31.03.2025 |

31.03.2030 |

|

Section 10(4D)- Income from transfer of Capital Asset located in IFSC |

31.03.2025 |

31.03.2030 |

|

Section 10(4F)- Royalty or Interest Income of a NonResident paid by IFSC |

31.03.2025 |

31.03.2030 |

|

Section 10(4H)-Income from transfer of shares by a non-resident or IFSC |

31.03.2026 |

31.03.2030 |

|

Section 47(viiad)(b) – relocation of original fund to resultant fund |

31.03.2025 |

31.03.2030 |

- Resultant fund definition u/s 47(viiad)(c) has been substituted to include a trust, company or LLP in IFSC referred u/s 80LA(1A) who has been granted a certificate as a retail scheme or an Exchange Traded Fund as per item (b) of sub-clause (I) of clause (c) of Explanation to s. 10(4D)

- Non-residents availing life insurance from the insurance office in IFSC and receiving proceeds on such policy issued by IFSC insurance intermediary office shall be exempt u/s 10(10D) even if the maximum premium paid in a year exceeds Rs. 5 Lacs or premium on ULIP exceeding Rs. 2.5 Lac a year.

- Non-residents or units of IFSC engaged in ship leasing (aircrafts were already covered) exempted from income being capital gain on transfer of equity shares u/s 10(4H).

- Non-residents or units of IFSC engaged in ship leasing (aircrafts were already covered) exempted from dividend paid u/s 10(34B).

- Section 2(22)(e) amended to exclude loans between group entities, where one is a finance company/unit in an IFSC and the parent entity is listed abroad, from being treated as dividends with effect from 1st April 2025

- Section 9A exempts fund management by eligible fund managers from being a business connection in India, subject to conditions. Clause (c) limits Indian participation in the fund to 5% of its corpus. Section 9A(8A) permits the Central Government to relax conditions for funds managed by IFSC-based fund managers starting operations by 31st March 2024. Amendment made that 5% rule to be checked on 1st April and 1st October. If not met, four months to comply and Conditions (a) to (m) may be relaxed for funds managed by IFSC-based managers where the date of commencement of operations is on or before 31st March 2030.

(w.e.f. 1st April 2025)

MISCELLANEOUS

- Various provisions of Chapter XII – G related to income of shipping companies (Tonnage Tax) have been expanded to include the “Inland Vessels” as well apart from the Ships. The following amendment shall be applicable from AY 2026-27 and subsequent AYs.

- Statement for Crypto assets – Tax is charged at 30% on crypto assets like cryptocurrency, with no deductions allowed except for the cost of the asset. Also, 1% tax is deducted when buying or selling crypto. It is proposed to introduce u/s 285BAA to track crypto transactions by periodic filing of crypto transactions.

- It is proposed to update the definition of “virtual digital assets” to make sure that all crypto-assets are included, even if they weren’t specifically listed before by amending definition u/s 2(47A). Any crypto-asset being a digital representation of value that relies on a cryptographically secured distributed ledger or a similar technology to validate and secure transactions, whether or not such asset is included in other clauses.

(w.e.f. 1st April 2026)

Read More Insights

Cart Infralog Limited & Anr vs. The Assistant Commissioner of CGST & Ors. – Calcutta High Court Judgment (29 July 2024)

Cart Infralog Limited & Anr vs. The Assistant Commissioner of CGST & Ors. – Calcutta High Court Judgment (29 July 2024) Home Insights Cart Infralog

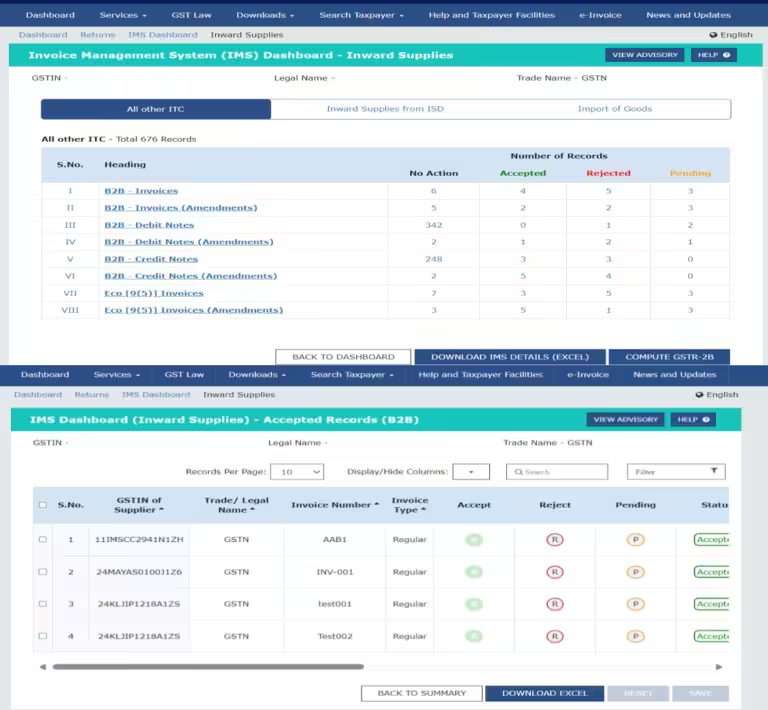

Invoice Management System (IMS) for Efficient GST Input Tax Credit (ITC) Management

Invoice Management System (IMS) for Efficient GST Input Tax Credit (ITC) Management Home Insights Invoice Management System (IMS) for Efficient GST Input Tax Credit (ITC)

Detailed Summary of Recommendations from the 54th GST Council Meeting

Detailed Summary of Recommendations from the 54th GST Council Meeting Home Insights Detailed Summary of Recommendations from the 54th GST Council Meeting Services Business Incorporation