Manappuram Finance Ltd. vs. Union of India & Ors. – Kerala High Court (29th July 2024)

Services

Business Incorporation & Compliance

Registration & Certification Services

GST Advisory & Compliance

Income Tax Advisory & Compliance

Accounting and Payroll Services

Audit & Assurance Services

International Tax Services

UAE Business Services

Financial Insights

Detailed Summary of CBIC Instruction No. 03/2025-GST

Union Budget 2025: Goods and Services Tax Comprehensive Overview

Union Budget 2025: Direct Tax Comprehensive Overview

Detailed Summary of Recommendations from the 54th GST Council Meeting

Court: High Court of Kerala

Judges: The Honourable Mr. Justice Gopinath P.

Case Number: W.P.(C) No. 24617 of 2022

Date: Monday, the 29th of July, 2024

Petitioner: Manappuram Finance Ltd, represented by Shri M.V. Babu, General Manager.

Respondents:

- The Union of India, Ministry of Finance

- The Central Board of Excise and Customs

- The Additional Director General, Goods and Services Tax Intelligence, Kochi Zonal Unit

- The Additional/Joint Commissioner of Central Tax, Kochi Central Tax Commissionerate

- The State of Kerala

Background:

Manappuram Finance Ltd., a company engaged in providing loans and other financial services, approached the High Court of Kerala with a writ petition challenging a show-cause notice issued by the Goods and Services Tax (GST) authorities. The notice questioned whether GST was payable on certain services provided by the petitioner, specifically concerning personal guarantees and the extension of loans.

Facts of the Case:

The case revolved around two primary issues:

- Whether GST is payable on services provided by the Managing Director of the company in the form of personal guarantees for loans taken by the company.

- Whether GST is payable on services related to the extension of loans by the petitioner to its subsidiary companies.

Contentions of the Petitioner:

The petitioner argued that the issues raised in the show-cause notice were already addressed and clarified by two circulars issued by the Central Board of Indirect Taxes and Customs (CBIC):

- Circular No. 204/16/2023-GST dated 27-10-2023.

- Circular No. 218/12/2024-GST dated 26-06-2024.

The petitioner contended that these circulars clarified that:

- The provision of personal guarantees by the Director to the company’s creditors without any consideration should not attract GST.

- The extension of loans to related entities, where consideration is represented only by way of interest or discount, is exempt from GST.

Contentions of the Respondents:

The respondents, represented by the Senior Standing Counsel, did not dispute the applicability of the clarifications provided in the aforementioned circulars to the issues raised in the show-cause notice.

Court’s Findings:

The Court observed that the clarifications provided by the CBIC in the cited circulars were binding on the authorities. The issues raised in the writ petition were found to be fully covered by these clarifications. The Court further noted that the show-cause notice did not address any issues beyond those already clarified.

Conclusion:

The Court allowed the writ petition and quashed the impugned show-cause notice, ruling in favor of the petitioner, Manappuram Finance Ltd. The Court’s decision was based on the binding clarifications issued by the CBIC, which resolved the matters in question.

Read More Insights

Ford India Private Limited vs. Deputy Commissioner (ST-III) – Madras High Court Judgment (24 June 2024)

Ford India Private Limited vs. Deputy Commissioner (ST-III) – Madras High Court Judgment (24 June 2024) Home Insights Ford India Private Limited vs. Deputy Commissioner

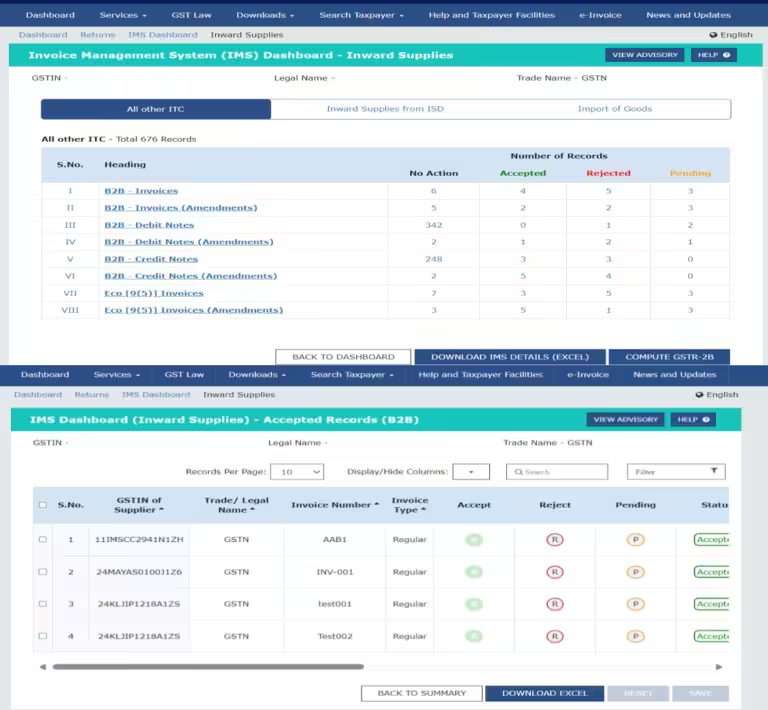

Invoice Management System (IMS) for Efficient GST Input Tax Credit (ITC) Management

Invoice Management System (IMS) for Efficient GST Input Tax Credit (ITC) Management Home Insights Invoice Management System (IMS) for Efficient GST Input Tax Credit (ITC)

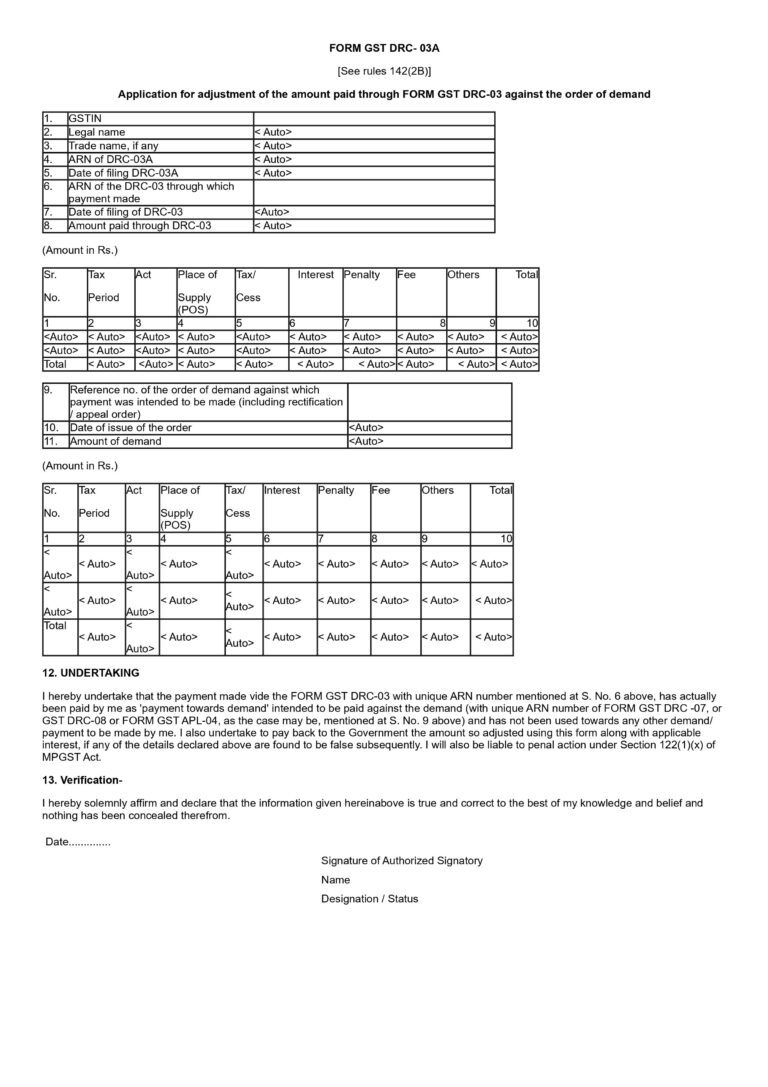

Clarification on GST Payments Through Form GST DRC-03 and Introduction of Form GST DRC-03A

Clarification on GST Payments Through Form GST DRC-03 and Introduction of Form GST DRC-03A Home Insights Clarification on GST Payments Through Form GST DRC-03 and