Novozymes South Asia Pvt. Ltd. vs. Joint Commissioner of State Goods and Services Tax & Ors. - Gujarat High Court (1st August 2024)

Services

Business Incorporation & Compliance

Registration & Certification Services

GST Advisory & Compliance

Income Tax Advisory & Compliance

Accounting and Payroll Services

Audit & Assurance Services

International Tax Services

UAE Business Services

Financial Insights

Detailed Summary of CBIC Instruction No. 03/2025-GST

Union Budget 2025: Goods and Services Tax Comprehensive Overview

Union Budget 2025: Direct Tax Comprehensive Overview

Detailed Summary of Recommendations from the 54th GST Council Meeting

Union Budget 2025: Direct Tax Comprehensive Overview

Detailed Summary of CBIC Instruction No. 03/2025-GST

Union Budget 2025: Goods and Services Tax Comprehensive Overview

Court: Gujarat High Court

Judges: Honourable Mr. Justice Bhargav D. Karia and Honourable Mr. Justice Niral R. Mehta

Case Number: R/Special Civil Application No. 1182 of 2023

Date: 1 August 2024

Petitioner: Novozymes South Asia Pvt. Ltd.

Respondent: Joint Commissioner of State Goods and Services Tax & Ors.

Background:

The petitioner, Novozymes South Asia Pvt Ltd, is engaged in the supply of products named “RhizoMyx” and “RhizoMyco.” These products are marketed as mycorrhizal biofertilizers, designed to enhance crop growth by improving nutrient and water absorption. The petitioner classified these products under Chapter Heading 3002 of the Customs Tariff Act, 1975, which attracts a tax rate of 12%. However, the petitioner sought a reclassification of these products under Chapter Heading 3101, which would reduce the tax rate to 5%.

Facts of the Case:

- Products and Classification: The petitioner has been classifying their products “RhizoMyx” and “RhizoMyco” under Chapter Heading 3002, which pertains to cultures of microorganisms, with a tax rate of 12%. The petitioner claims these products are biofertilizers that should be classified under Chapter Heading 3101, which covers animal or vegetable fertilizers, thus attracting a lower tax rate of 5%.

- Ingredients of the Products:

- RhizoMyco: Contains Potassium Humate, Soluble Seaweed Extract, Amino Acids, Vitamins, Surfactant, Endo Mycorrhizae Powder, and Ectomycorrhizal Powder.

- RhizoMyx: Contains similar ingredients, including Mycorrhizae instead of Endo and Ecto Mycorrhizal Powders.

- Application for Advance Ruling: On 13 July 2018, the petitioner filed an application with the Gujarat Authority for Advance Ruling (GAAR) to determine the correct classification of these products.

- GAAR’s Ruling: On 2 July 2020, GAAR classified the products under Chapter Heading 3002, stating that they qualify as biofertilizers produced by culturing microorganisms, thus taxable at 12%.

- Appeal to Appellate Authority: The petitioner appealed this ruling, but on 8 March 2021, the Appellate Authority affirmed GAAR’s classification, maintaining the 12% tax rate.

Contentions of the Petitioner:

- Contradictory Decisions: The petitioner highlighted that in a similar case involving M/S. GB Agro Industries, the Appellate Authority classified similar biofertilizers under Chapter Heading 3105, which would attract a lower tax rate of 5%.

- Request for Reconsideration: The petitioner argued that the same rationale applied in the GB Agro Industries case should apply to their products. They requested the court to remand the matter back to the Appellate Authority for reconsideration, ensuring a consistent and lawful classification.

Contentions of the Respondents:

- Support for the Original Classification: The respondents, represented by the learned Assistant Government Pleader and Advocate, did not contest the petitioner’s claim regarding the contradictory decisions. They supported the Appellate Authority’s original classification of the petitioner’s products under Chapter Heading 3002.

Court’s Findings:

- Contradictory Classification: The court acknowledged that the Appellate Authority had indeed rendered contradictory decisions in similar cases. The petitioner’s products were classified under Chapter 3002, while the products in the GB Agro Industries case were classified under Chapter 3105.

- Need for Reconsideration: The court recognized the inconsistency in the decisions and deemed it necessary for the Appellate Authority to reconsider the classification of the petitioner’s products.

Conclusion:

The Gujarat High Court, after hearing both parties, decided to remand the matter back to the Appellate Authority. The court directed the Appellate Authority to reconsider the classification of the petitioner’s products “RhizoMyx” and “RhizoMyco” in light of the decision made in the GB Agro Industries case. The Appellate Authority was instructed to re-evaluate the facts and issue a fresh ruling, ensuring consistency in the application of the law.

This order underscores the importance of uniformity in tax rulings and the court’s commitment to ensuring that similar cases are treated alike, thereby preventing any potential injustice.

Read More Insights

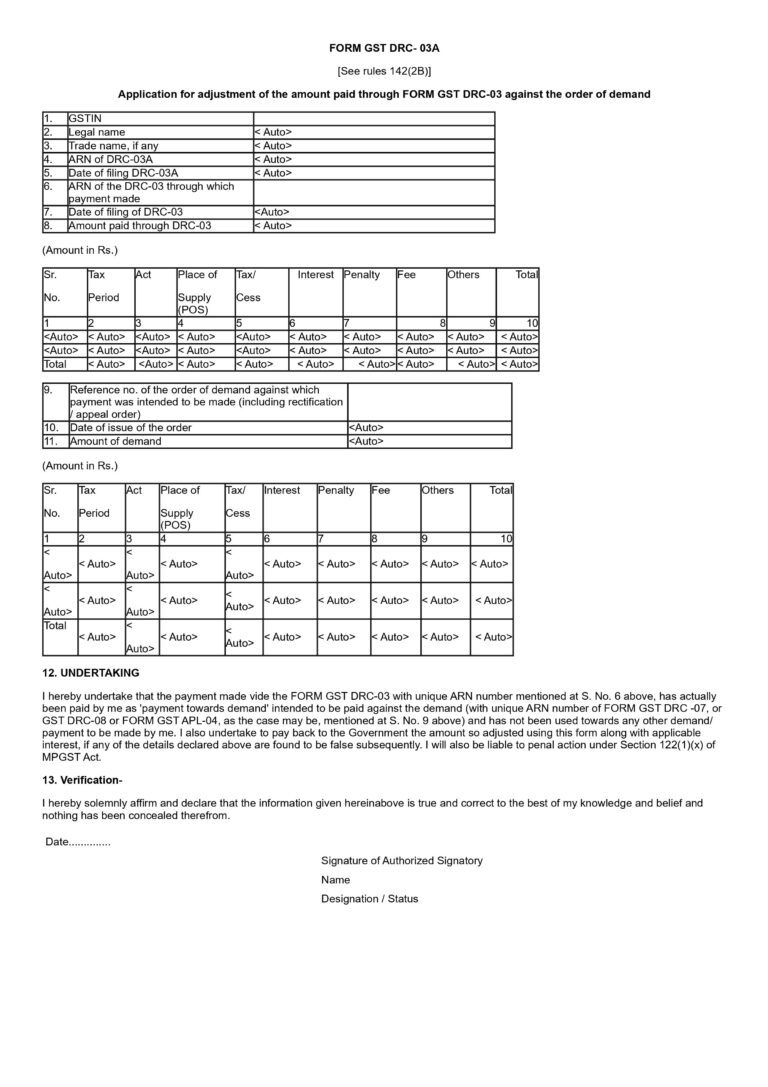

Clarification on GST Payments Through Form GST DRC-03 and Introduction of Form GST DRC-03A

Clarification on GST Payments Through Form GST DRC-03 and Introduction of Form GST DRC-03A Home Insights Clarification on GST Payments Through Form GST DRC-03 and

Union Budget 2025: Direct Tax Comprehensive Overview

Union Budget 2025: Direct Tax Comprehensive Overview Home Insights Union Budget 2025: Direct Tax Comprehensive Overview Services Business Incorporation & Compliance Company Registration LLP Registration

Cart Infralog Limited & Anr vs. The Assistant Commissioner of CGST & Ors. – Calcutta High Court Judgment (29 July 2024)

Cart Infralog Limited & Anr vs. The Assistant Commissioner of CGST & Ors. – Calcutta High Court Judgment (29 July 2024) Home Insights Cart Infralog