Asianet Digital Network Private Ltd vs. The Assistant State Tax Officer - Kerala High Court (29 November, 2018)

Services

Business Incorporation & Compliance

Registration & Certification Services

GST Advisory & Compliance

Income Tax Advisory & Compliance

Accounting and Payroll Services

Audit & Assurance Services

International Tax Services

UAE Business Services

Financial Insights

Detailed Summary of CBIC Instruction No. 03/2025-GST

Union Budget 2025: Goods and Services Tax Comprehensive Overview

Union Budget 2025: Direct Tax Comprehensive Overview

Detailed Summary of Recommendations from the 54th GST Council Meeting

Court: Kerala High Court

Judge: The Honourable Mr. Justice Dama Seshadri Naidu

Case Number: WP(C) No. 38747 of 2018

Date of Judgment: 29 November 2018

Petitioner: Asianet Digital Network Private Ltd., represented by Mr. Alex Jose Paikada, Legal Executive

Respondents:

- The Assistant State Tax Officer, Mobile Squad No.2, Kollam

- The State Tax Officer, Office of the Assistant Commissioner of State Taxes, Kerala GST, Kollam

- The Superintendent of Central Excise and Central Tax, Kazhakkoottam Range, Thiruvananthapuram

Background:

Asianet Digital Network Private Ltd., a prominent cable TV and Internet service provider, was involved in the transportation of a consignment of set-top boxes. On 14 November 2018, the Assistant State Tax Officer (ASTO) intercepted and detained the conveyance transporting these goods. The ASTO issued a notice of discrepancy citing a mismatch between the delivery challan and the e-way bill. Specifically, the e-way bill recorded the value of the goods as Rs. 10,04,888, whereas the delivery challan showed only Rs. 3,20,000.

The petitioner argued that this discrepancy was due to a clerical error—specifically, that the delivery challan mistakenly recorded the value of only 200 set-top boxes, leaving out the value of the remaining 600 set-top boxes due to a computer error. The petitioner contended that the e-way bill accurately reflected the total value of the goods and that there was no intention to suppress any information or evade tax.

Petitioner’s Arguments:

- Clerical Error Explanation: The petitioner claimed that the discrepancy was unintentional and resulted from a computer error in the preparation of the delivery challan. The e-way bill had correctly reflected the total value of Rs. 10,04,888 for 800 set-top boxes, but the delivery challan incorrectly recorded only Rs. 3,20,000 for 200 set-top boxes, with the value for the remaining 600 set-top boxes erroneously shown as zero.

- No Tax Liability: The petitioner argued that the set-top boxes were being transferred from one business location to another within the same organization, and therefore, no tax liability arose from the transaction. Consequently, they asserted that the detention of the goods under Section 129 of the GST Act was not justified.

- Interim Relief Request: The petitioner sought the court’s intervention to release the detained goods by challenging the ASTO’s order and seeking a declaration that the detention was unlawful. They also sought interim relief to have the goods released without further financial burden or penalties.

Respondents’ Arguments:

- Justification of Detention: The Government Pleader representing the respondents argued that the discrepancy between the e-way bill and the delivery challan was a significant issue that warranted the detention of the goods. The ASTO acted within its rights under Section 129 of the GST Act, which mandates the detention, seizure, and release of goods in transit when discrepancies are detected.

- Compliance with Section 129: The respondents contended that for the interim release of the detained goods, the petitioner must comply with Section 129(1)(a) of the GST Act. This section requires the petitioner to furnish a bank guarantee equivalent to the amount of tax and penalty on the detained goods.

- Adjudication by State Tax Officer: The respondents further argued that the petitioner’s explanations regarding the clerical error should be presented before the State Tax Officer during the subsequent adjudication process, rather than being decided by the court at this stage.

Court’s Findings:

Justice Dama Seshadri Naidu, after hearing both parties, made several observations:

- Admissibility of the Petitioner’s Explanation: The court acknowledged the petitioner’s explanation regarding the clerical error in the delivery challan. However, it noted that such explanations should be adjudicated by the State Tax Officer in the due course of legal proceedings.

- Legality of Detention: The court found that the ASTO’s actions, including the detention of the goods under Section 129, were legally justified given the discrepancy between the e-way bill and the delivery challan. The court stated that the Department’s demand for compliance with Section 129(1)(a) was appropriate and could not be faulted.

- Proportional Penalty: The court, however, observed that the Department’s insistence on imposing both the tax and penalty on the entire consignment was excessive. The court reasoned that since the delivery challan correctly reflected the value of 200 set-top boxes, the petitioner should be required to furnish a bank guarantee and personal bond under Section 129(1)(a) only for the remaining 600 set-top boxes, whose value had not been properly reflected due to the error.

Conclusion:

The Kerala High Court provided partial relief to the petitioner by ordering the release of the detained goods, subject to the petitioner furnishing a bank guarantee and personal bond limited to the value of the 600 set-top boxes not reflected in the delivery challan. The court disposed of the writ petition with these directions, allowing the petitioner to contest the issue further before the State Tax Officer during the adjudication process.

This judgment highlights the court’s balanced approach in dealing with procedural lapses while ensuring compliance with statutory provisions under the GST Act.

Read More Insights

Detailed Summary of CBIC Instruction No. 03/2025-GST

Guidelines for Streamlined Processing of GST Registration Applications – Issued on 17th April 2025 by the GST Policy Wing, CBIC Home Insights Guidelines for Streamlined

Tvl.Vibis Natural Bee Farms vs. The Deputy State Tax Officer – Madras High Court (26 July, 2024)

Tvl.Vibis Natural Bee Farms vs. The Deputy State Tax Officer – Madras High Court (26 July, 2024) Home Insights Tvl.Vibis Natural Bee Farms vs. The

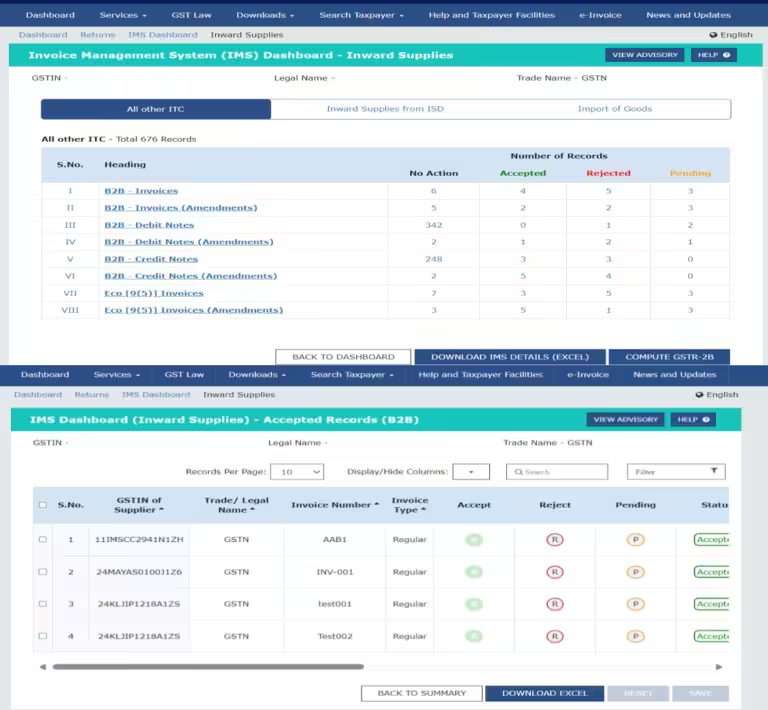

Invoice Management System (IMS) for Efficient GST Input Tax Credit (ITC) Management

Invoice Management System (IMS) for Efficient GST Input Tax Credit (ITC) Management Home Insights Invoice Management System (IMS) for Efficient GST Input Tax Credit (ITC)