Cart Infralog Limited & Anr vs. The Assistant Commissioner of CGST & Ors. - Calcutta High Court Judgment (29 July 2024)

Services

Business Incorporation & Compliance

Registration & Certification Services

GST Advisory & Compliance

Income Tax Advisory & Compliance

Accounting and Payroll Services

Audit & Assurance Services

International Tax Services

UAE Business Services

Financial Insights

Detailed Summary of CBIC Instruction No. 03/2025-GST

Union Budget 2025: Goods and Services Tax Comprehensive Overview

Union Budget 2025: Direct Tax Comprehensive Overview

Detailed Summary of Recommendations from the 54th GST Council Meeting

Court: Calcutta High Court (Appellate Side)

Date: 29th July, 2024

Case No.: WPA 15304 of 2024

Judge: Raja Basu Chowdhury, J.

Petitioners: M/s. Cart Infralog Limited & Anr.

- Counsel for Petitioners: Mr. Ankit Kanodia, Ms. Megha Agarwal, Mr. Piyush Khaitan

Respondents: The Assistant Commissioner of CGST & CX, Ballygunge Division & Ors.

- Counsel for Respondents: Mr. Kaushik Dey, Ms. Aishwarya Raijashree (CGST Authority)

- Counsel for State: Mr. Anirban Ray, Mr. Md. T.M. Siddiqui, Mr. Tanmoy Chakborty, Mr. Saptak Sanyal

- Counsel for Union of India (UOI): Mr. Ashoke Kr. Bhowmik, Mr. Ayanabha Raha

Background

- Scope of Petition: The petitioners challenged an adjudication order passed under Section 73(9) of the CGST/WBGST Act, 2017, dated 29th April 2024, which was issued in Form GST DRC-07. The petitioners did not press for Prayer-A but confined their challenge to the other prayers in the writ petition.

- Dispute: The case revolves around the reversal of Input Tax Credit (ITC) claimed by the petitioners. The ITC, claimed under IGST, CGST, and SGST, was found reversible because the petitioners filed GSTR-3B after the last date prescribed under Section 16(4) of the CGST Act.

- Petitioners’ Argument: The petitioners argued that although the GSTR-3B was filed late (on 31st October 2019 instead of the due date of 20th October 2019), an amendment to Section 16(4) has been proposed in Finance Bill No. 2, 2024 (Bill No. 55 of 2024). This amendment would allow registered persons to claim ITC if the return under Section 39 of the Act was filed by 30th November 2021, for financial years 2017-18 to 2020-21. The petitioners contended that once this bill becomes an Act, they would be entitled to the ITC worth ₹63,28,114/-.

- Respondents’ Argument: The respondents acknowledged that the bill has been introduced in Parliament but argued that it has not yet become an Act. They suggested that the petitioners’ remedy lies in filing an appeal rather than seeking intervention from the Court. However, if the Court were inclined to admit the writ petition, they requested that the petitioners be directed to secure a portion of the disputed amount.

Court’s Decision

- Interim Order: Considering the potential applicability of the proposed amendment to Section 16(4) of the CGST Act, the Court granted an interim order to the petitioners. The Court recognized that the Finance Bill, if passed, would cover a significant portion of the determination made under Section 73 of the CGST Act for the financial year 2018-19.

- Deposit Requirement: The Court directed the petitioners to deposit ₹25 lakhs with the Registrar General within three weeks. This amount is to be kept in an interest-bearing fixed deposit with a nationalized bank until further orders.

- Protection from Coercive Action: The Court issued an unconditional order restraining the respondents from taking any coercive actions against the petitioners concerning the enforcement of the adjudication order dated 29th April 2024. This interim protection will last for three weeks, and if the petitioners comply with the deposit requirement, the interim order will continue until the end of September 2024 or until further orders.

- Liberty to Exchange Affidavits: The parties were granted the liberty to exchange affidavits, and they were also given the liberty to mention the case for inclusion.

Conclusion

The Court’s interim order provides temporary relief to the petitioners, allowing them to secure their position while awaiting the potential passage of the Finance Bill No. 2, 2024, which may significantly impact the outcome of their case. The next steps will depend on the petitioners’ compliance with the deposit order and further developments concerning the proposed legislative amendment.

Read More Insights

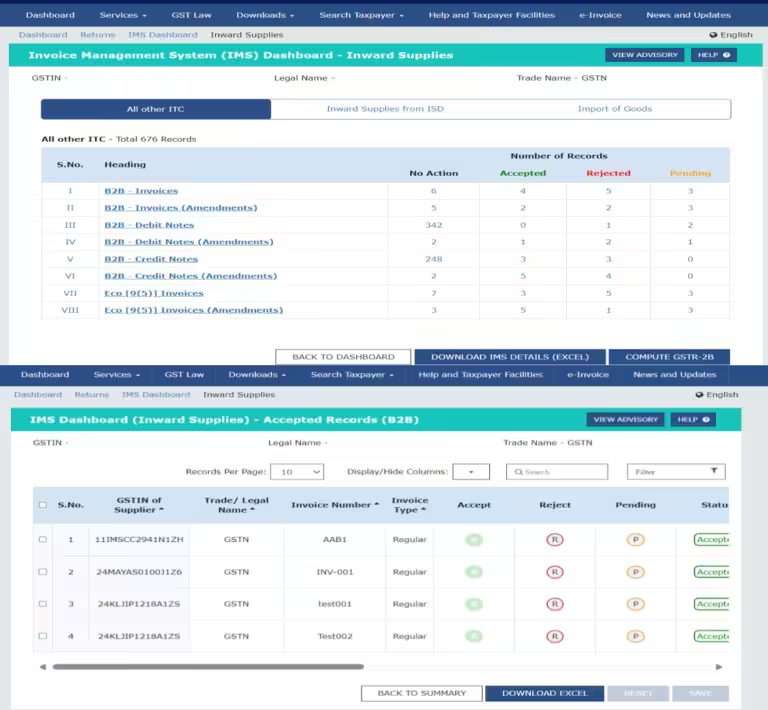

Invoice Management System (IMS) for Efficient GST Input Tax Credit (ITC) Management

Invoice Management System (IMS) for Efficient GST Input Tax Credit (ITC) Management Home Insights Invoice Management System (IMS) for Efficient GST Input Tax Credit (ITC)

Detailed Summary of Recommendations from the 54th GST Council Meeting

Detailed Summary of Recommendations from the 54th GST Council Meeting Home Insights Detailed Summary of Recommendations from the 54th GST Council Meeting Services Business Incorporation

Tvl.Vibis Natural Bee Farms vs. The Deputy State Tax Officer – Madras High Court (26 July, 2024)

Tvl.Vibis Natural Bee Farms vs. The Deputy State Tax Officer – Madras High Court (26 July, 2024) Home Insights Tvl.Vibis Natural Bee Farms vs. The