Clarification on GST Payments Through Form GST DRC-03 and Introduction of Form GST DRC-03A

Services

Business Incorporation & Compliance

Registration & Certification Services

GST Advisory & Compliance

Income Tax Advisory & Compliance

Accounting and Payroll Services

Audit & Assurance Services

International Tax Services

UAE Business Services

Financial Insights

Detailed Summary of CBIC Instruction No. 03/2025-GST

Union Budget 2025: Goods and Services Tax Comprehensive Overview

Union Budget 2025: Direct Tax Comprehensive Overview

Detailed Summary of Recommendations from the 54th GST Council Meeting

Issue with Payments Through Form GST DRC-03

Many taxpayers mistakenly used Form GST DRC-03 to pay GST liabilities arising from demand orders issued by the Jurisdictional Proper Officer. However, Form GST DRC-03 is meant solely for voluntary payment of taxes, not for settling liabilities created by an order. The correct procedure for paying such liabilities is by debiting the Electronic Liability Ledger.

Due to this mistake, payments made through Form GST DRC-03 were not applied to the demand liability reflected in the Electronic Liability Ledger. As a result, taxpayers were forced to approach GST authorities to appropriate these payments, which was not legally permissible.

Resolution by GST Council: Introduction of Form GST DRC-03A

To resolve this issue, the GST Council introduced Form GST DRC-03A. This form allows taxpayers to appropriate payments made through Form GST DRC-03 against demand liabilities recorded in the Electronic Liability Ledger.

Steps to File Form GST DRC-03A

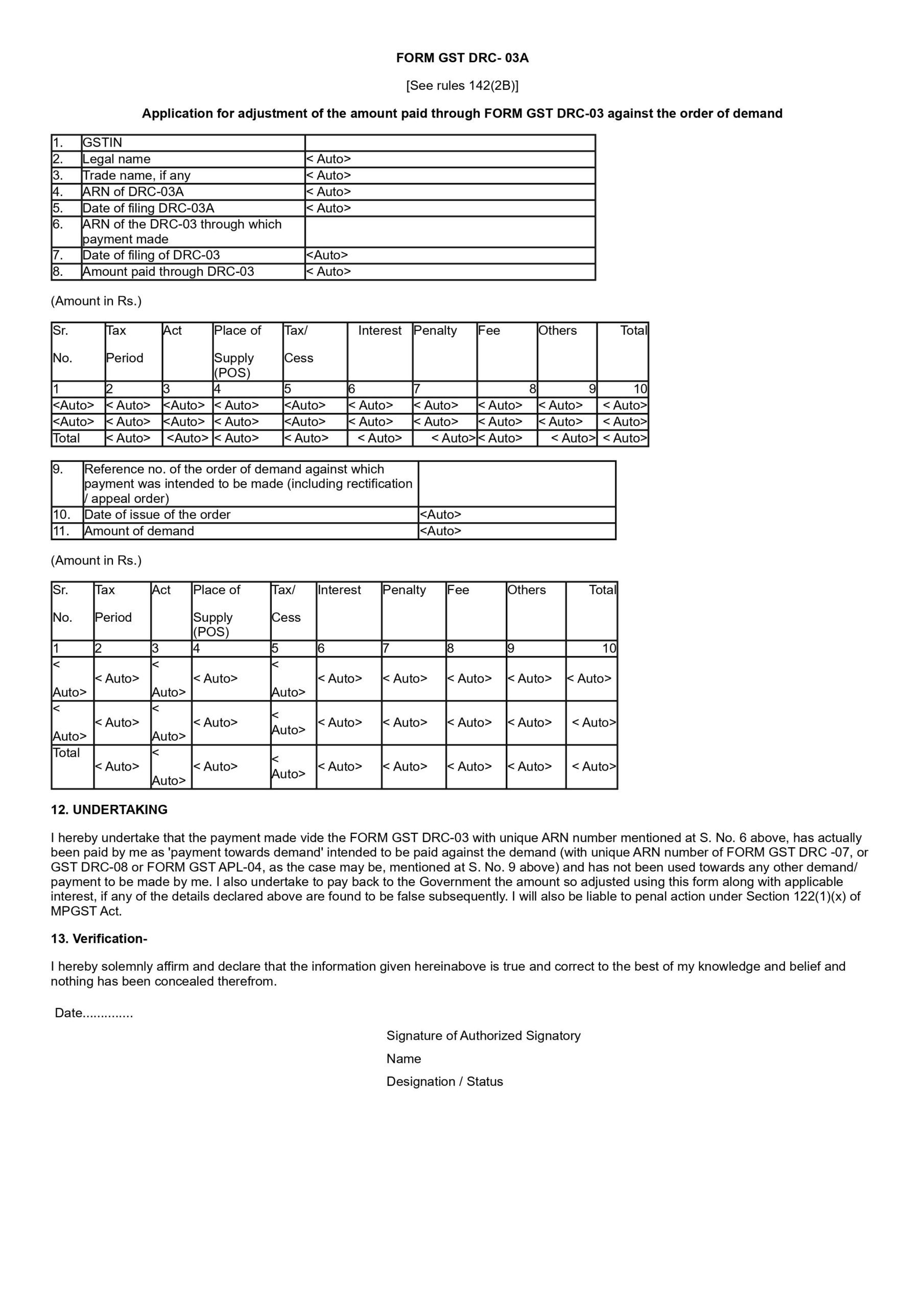

- Open Form GST DRC-03A on the GST portal.

- Provide the ARN (Application Reference Number) of the Form GST DRC-03 used to make the payment.

- The details of Form GST DRC-03 will auto-populate in Form GST DRC-03A.

- Provide the reference number of the demand order (including rectification/appeal order) for which the payment was intended.

- The demand details will be auto-populated in the form.

- Verify the undertaking and verification section of the form.

- File the form using Digital Signature Certificate (DSC) or Electronic Verification Code (EVC).

Upon successful filing of Form GST DRC-03A, the demand liability will be considered paid to the extent of the amount paid via Form GST DRC-03. This form acts as a bridge between payments made voluntarily (Form GST DRC-03) and payments required against the Electronic Liability Ledger.

Use Case: Pre-Deposit Payment Before Filing an Appeal

Form GST DRC-03A can also be used for making pre-deposit payments before filing an appeal with the GST Tribunal. Although the GST Tribunal has not yet been constituted, taxpayers are required to make a pre-deposit of 20% of the disputed tax amount to obtain a stay on demand recovery.

Challenges:

- No Mechanism for Pre-Deposit Payments: Since Form GST APL-05 is not available, taxpayers mistakenly used Form GST DRC-03 for this purpose.

- Solution:

- For those who have not yet paid, the amount should be paid against the demand in the Electronic Liability Ledger.

- For those who have already paid through Form GST DRC-03, Form GST DRC-03A should be filed to appropriate the payment toward the demand.

After making the payment as per the guidelines, taxpayers must file an undertaking with the jurisdictional officer, stating their intention to file an appeal once the GST Appellate Tribunal is operational. This undertaking will stay the demand recovery until the appeal can be filed.

Conclusion

Form GST DRC-03A provides relief to taxpayers who inadvertently used Form GST DRC-03 for payments that should have been made through the Electronic Liability Ledger. Additionally, it serves as a temporary solution for making pre-deposit payments before the establishment of the GST Tribunal.

Read More Insights

Cart Infralog Limited & Anr vs. The Assistant Commissioner of CGST & Ors. – Calcutta High Court Judgment (29 July 2024)

Cart Infralog Limited & Anr vs. The Assistant Commissioner of CGST & Ors. – Calcutta High Court Judgment (29 July 2024) Home Insights Cart Infralog

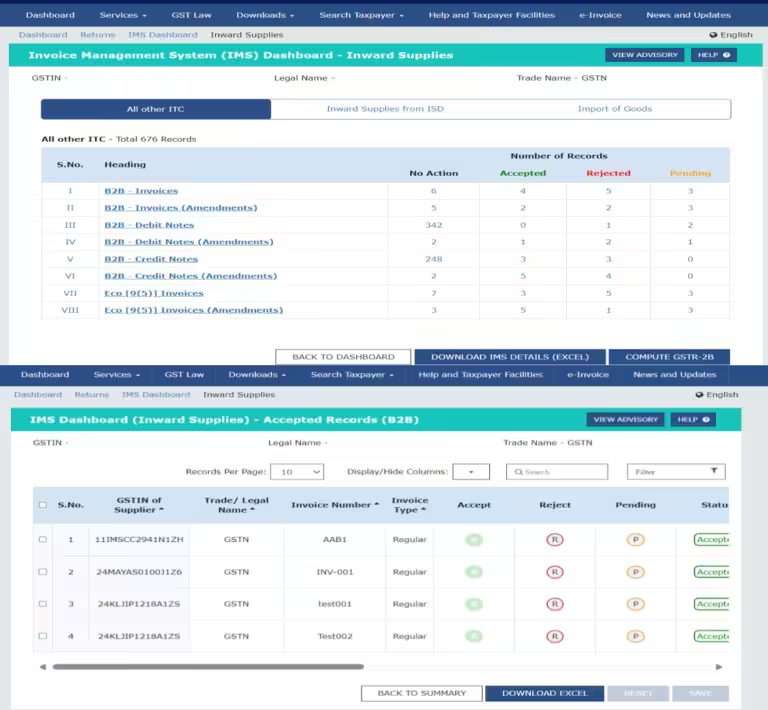

Invoice Management System (IMS) for Efficient GST Input Tax Credit (ITC) Management

Invoice Management System (IMS) for Efficient GST Input Tax Credit (ITC) Management Home Insights Invoice Management System (IMS) for Efficient GST Input Tax Credit (ITC)

Detailed Summary of Recommendations from the 54th GST Council Meeting

Detailed Summary of Recommendations from the 54th GST Council Meeting Home Insights Detailed Summary of Recommendations from the 54th GST Council Meeting Services Business Incorporation