Union Budget 2025: Goods and Services Tax Comprehensive Overview

Services

Business Incorporation & Compliance

Registration & Certification Services

GST Advisory & Compliance

Income Tax Advisory & Compliance

Accounting and Payroll Services

Audit & Assurance Services

International Tax Services

UAE Business Services

Financial Insights

Detailed Summary of CBIC Instruction No. 03/2025-GST

April 21, 2025

Union Budget 2025: Goods and Services Tax Comprehensive Overview

February 20, 2025

Union Budget 2025: Direct Tax Comprehensive Overview

February 12, 2025

Detailed Summary of Recommendations from the 54th GST Council Meeting

September 10, 2024

AMENDMENTS IN DEFINITIONS CONTAINED IN SECTION 2

- It is proposed to amend the definition of “Input Service Distributor” (ISD) under clause (61) of section 2 of the GST Act to explicitly provide that Input Service Distributors can distribute tax credits for interstate transactions where the tax is paid by the recipient under reverse charge.

- It is also proposed to insert a new clause (116A) in section 2to define “unique identification marking” as a special mark used for tracking goods. The mark will be distinct, secure, and impossible to remove, ensuring goods can be traced accurately throughout the supply chain.

AMENDMENTS IN PROVISIONS RELATED TO TIME OF SUPPLY

- The Bill seeks to omit sub-section (4) of section 12 and sub-section (4) of section 13 of the Central Goods and Services Tax Act so as to remove the provision for time of supply in respect of transaction in vouchers, the same being neither supply of goods nor supply of services.

- The proposal seeks to replace the term “plant or machinery” with “plant and machinery” in Clause (d) of Sub-section (5) of Section 17 of the Central Goods and Services Tax (CGST) Act. This change is intended to remove any ambiguity in interpretation regarding the eligibility for Input Tax Credit (ITC) in cases where businesses acquire plant and machinery. The change ensures that there is no confusion about whether the term refers to only plant or only machinery-businesses can claim ITC for both plant and machinery.

AMENDMENTS RELATED TO PENAL PROVISION

- Earlier, there was no requirement for a pre-deposit of the penalty amount in the case of an appeal before the Appellate Authority. The amendment under section 107(6) and 112(8) proposes a pre-deposit of 10% of the penalty amount must be paid before an appeal can be filed with the Appellate Authority or Appellate Tribunal against an order that involves only the demand for penalty (without involving any demand for tax).

- The Bill seeks to insert a new section 122B in the Central Goods and Services Tax Act to provide for penal provisions for contraventions of the provision relating to track and trace mechanism.

OTHER AMENDMENTS

- Proviso to section 34(2) is being substituted to provide reversal of corresponding input tax credit in respect of a credit-note, if availed, by the registered recipient, for the purpose of reduction of tax liability of the supplier in respect of the said credit note.

- Earlier, the statement of Input Tax Credit (ITC) was auto-generated by the GST system. The recipient could claim ITC only if the ITC was available to them under the provisions of the CGST Act. The term “auto-generated” is removed. This change provides flexibility to make corrections or adjustments in the ITC statement when needed. it now covers not only the situation where the recipient claims ITC, but also other cases where ITC may be denied or unavailable due to other reasons under the Act.

- Section 148A is being inserted, which will provide the legal basis to track and monitor certain goods throughout their journey in the supply chain. The aim is to ensure transparency and reduce illegal activities.

- Schedule III is being amended to insert clause 8(aa) to provide warehoused in a Special Economic Zone (SEZ) or a Free Trade Warehousing Zone (FTWZ), and are supplied to any person before clearance for export or to the Domestic Tariff Area (DTA), shall be treated neither as a supply of goods nor as a supply of services.

Read More Insights

Ford India Private Limited vs. Deputy Commissioner (ST-III) – Madras High Court Judgment (24 June 2024)

August 20, 2024

No Comments

Ford India Private Limited vs. Deputy Commissioner (ST-III) – Madras High Court Judgment (24 June 2024) Home Insights Ford India Private Limited vs. Deputy Commissioner

Standard Chartered Bank vs. The Principal Commissioner Of Central Tax & Others – Telangana High Court Judgment (11 July 2024)

August 6, 2024

No Comments

Standard Chartered Bank vs. The Principal Commissioner Of Central Tax & Others – Telangana High Court Judgment (11 July 2024) Home Insights Standard Chartered Bank

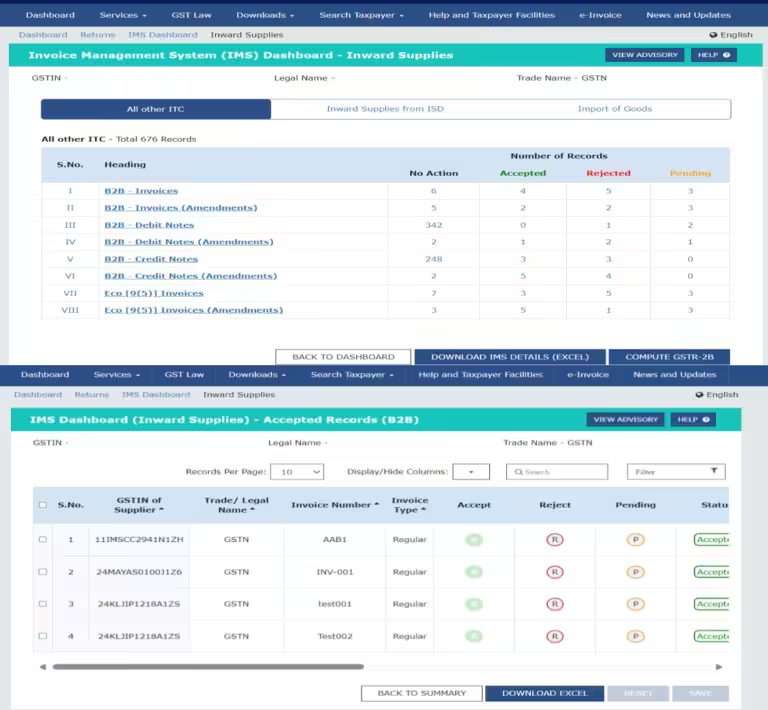

Invoice Management System (IMS) for Efficient GST Input Tax Credit (ITC) Management

September 5, 2024

No Comments

Invoice Management System (IMS) for Efficient GST Input Tax Credit (ITC) Management Home Insights Invoice Management System (IMS) for Efficient GST Input Tax Credit (ITC)

Services

Business Incorporation & Compliance

Registration & Certification Services

GST Advisory & Compliance

Income Tax Advisory & Compliance

Accounting and Payroll Services

Audit & Assurance Services

International Tax Services

UAE Business Services

Financial Insights

Detailed Summary of CBIC Instruction No. 03/2025-GST

April 21, 2025

Union Budget 2025: Goods and Services Tax Comprehensive Overview

February 20, 2025

Union Budget 2025: Direct Tax Comprehensive Overview

February 12, 2025

Detailed Summary of Recommendations from the 54th GST Council Meeting

September 10, 2024

Union Budget 2025: Direct Tax Comprehensive Overview

February 12, 2025

Detailed Summary of CBIC Instruction No. 03/2025-GST

April 21, 2025